Jump to section

- What is a fully insured health plan?

- How does a fully insured health plan work?

- Why fully insured health plans became the default option

- Why many midsize employers are reconsidering fully insured plans

- What challenges do fully insured employers face?

- What are the alternatives to fully insured health plans?

- What is self-funding with ParetoHealth captive?

- Fully insured health plans shouldn’t be the default

What is a fully insured health plan?

A fully insured health plan is a traditional health insurance arrangement in which an employer pays a fixed premium to an insurance company. The insurance company assumes full financial responsibility for employee medical and pharmacy claims.

For decades, fully insured health plans were the most common choice for midsize employers because the model appeared simple and predictable.

However, the healthcare landscape has changed.

With healthcare inflation nearing 10% (outpacing both wage and revenue growth) midsize employers are rightly asking tough questions:

Why have traditional fully insured plans failed to control rising costs?

And why are employers still kept in the dark, with limited access to claims data, pharmacy rebates, and options to reduce healthcare spend?

What is a health insurance premium?

A health insurance premium is the amount an employer pays, typically monthly, to an insurance company to maintain health coverage for their population.

The health insurance premium covers many different expenses including administrative costs, insurance company profit, taxes, reinsurance, and the actual cost of healthcare. However, fully insured premiums are like a black box. Fully insured employers write a big check with no visibility into what is actually being funded.

What is a medical or pharmacy claim?

A medical claim is a request for payment submitted by a healthcare provider to an insurance company for services rendered, such as a doctor’s visit or a procedure.

A pharmacy claim is a request sent by a pharmacy to a patient’s insurance company for reimbursement of a prescription medication.

How does a fully insured health plan work?

Here’s how fully insured health plans operate:

-

-

-

- The employer pays a fixed premium: The employer pays a set premium which the insurance company collects regardless of how much healthcare employees actually use.

- The insurance company pools that money with payments from other employers.

- The insurance company uses those funds to:

• Pay themselves to process claims

• Pay medical and pharmacy claims

• Keep any remaining dollars as profit - Annual renewal sets next year’s costs: At renewal, the insurance company gives the employer a new amount to pay as their premium, often higher than the prior year, with limited insight into what drove the increase.

-

-

Employers typically receive minimal claims data or pharmacy rebate transparency. As a result, they have limited visibility into where their healthcare dollars are going or what actions could meaningfully impact future healthcare costs.

Why fully insured health plans became the default option

Fully insured plans historically made sense for midsize employers because they:

-

-

-

- Required minimal internal expertise

-

-

-

-

-

- Shifted claims risk entirely to the insurance company

-

-

-

-

-

- Simplified budgeting and administration

-

-

For organizations prioritizing simplicity over control on healthcare spend, the fully insured model delivered peace of mind.

Why many midsize employers are reconsidering fully insured plans

Midsize employers are reconsidering fully insured health plans because the healthcare landscape has changed significantly over the past decade.

Healthcare costs continue to rise faster than wages and inflation, and employers are experiencing an increase in year-to-year volatility due to the increase in cost and frequency of large claims.

According to the U.S. Department of Health and Human Services, more than 4 in 5 large employers are self-funded. Midsize employers are increasingly following the same path, driven by the need for greater control, transparency, and long-term cost containment.

What challenges do fully insured employers face?

-

-

-

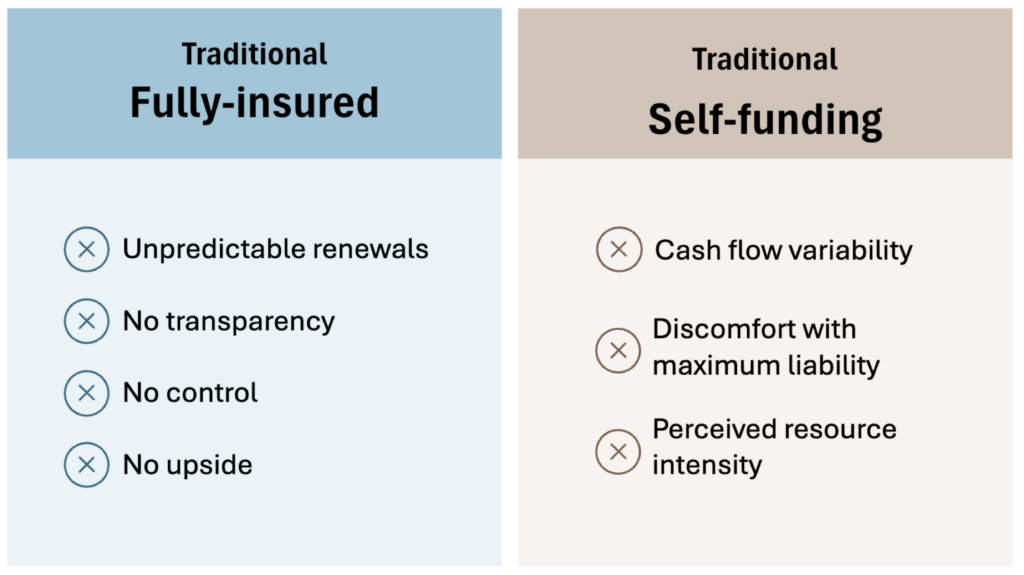

- High fixed costs: Because the insurance company takes on the risk of paying large claims, they build in extra cushion to protect themselves and cover administrative costs. That’s why fully insured plans come with high fixed costs. Fully insured employers are paying for the insurance company’s safety net and administrative inefficiency, not just the actual cost of healthcare.

-

-

-

-

-

- Little to no visibility into cost drivers: And once fully insured employers have paid their health insurance premium, they are left in the dark. There are limited claims data and no pharmacy rebate transparency to know how those dollars are spent. Fully insured employers can’t see which conditions or claims are driving healthcare costs.

-

-

-

-

-

- No levers to drive down healthcare costs: Fully insured employers don’t have any real options to control spending. Traditional fully insured health plans are one-size-fits-all because that’s easier for the insurance company to manage. Fully insured employers don’t have the leverage to tailor benefits to their population or make strategic changes that could help them save money on healthcare costs.

-

-

What are the alternatives to fully insured health plans?

Traditional self-funding (self-insurance)

Employers pay healthcare claims as they occur rather than paying a fixed fee.

Upside:

-

-

-

- Employers pay only for healthcare employees actually use.

-

-

-

-

-

- Greater claims data and pharmacy rebate transparency so employers can see what is driving costs and make informed decisions.

-

-

-

-

-

- Potential savings when claims are lower than expected because unused dollars stay with the employer instead of being retained by an insurance company.

-

-

Tradeoff:

-

-

-

- Exposure to large or unexpected claims, which can create significant financial volatility if not properly managed. To manage this risk, many self-funded employers purchase stop-loss insurance.

- Exposure to large or unexpected claims, which can create significant financial volatility if not properly managed. To manage this risk, many self-funded employers purchase stop-loss insurance.

-

-

What is stop-loss insurance?

Stop-loss insurance is a policy that protects employers from large or unexpected medical claims when they self-fund their health plans.

Level-funded health plans

Level-funded health plans are a type of self-funded plan that combines estimated claims, administrative fees, and stop-loss insurance into a fixed payment.

Upside:

-

-

-

- Predictable monthly expense

-

-

-

-

-

- Potential upside if claims are lower than expected

-

-

-

-

-

- Access to medical and pharmacy claims data

-

-

Tradeoffs:

-

-

-

- Limited transparency into claims data and pharmacy rebates.

-

-

-

-

-

- Very difficult to leave. Employers remain financially responsible for claims incurred during the plan year for months after leaving a level-funded plan. And in some cases more than a year.

- Sold as having the potential for savings, but any unused funds are frequently applied to future plan costs rather than returned directly to the employer.

-

-

Individual Health Reimbursement Arrangement (ICHRA)

An ICHRA reimburses employees for individual health insurance premiums and eligible medical expenses.

Upside:

-

-

-

- Employers cap their spend with fixed monthly allowances instead of providing a traditional group health plan.

-

-

-

-

-

- Lower barriers for offering employee benefits especially for employers without the scale or resources to manage a health plan.

-

-

Tradeoffs:

-

-

-

- Employees must navigate the individual health insurance market on their own, which can be confusing and time-consuming without expert support.

-

-

-

-

-

- Health insurance coverage is often more expensive with less protection because individual health plans don’t benefit from employer group pricing.

- Employee experience can suffer, particularly if employees struggle to compare plans, face higher out-of-pocket costs, or feel the employer is less invested in their benefits.

- Additionally, if the employer later chooses to reinstate group benefits, they are treated as a brand new group. As a result, they are rated solely on manual rates, which often results in significantly higher premiums.

-

-

Self-funding with a ParetoHealth employee benefits captive

To receive the benefits from self-funding while addressing the risk and volatility that comes with traditional self-insurance, thousands of midsize employers have chosen self-funding with a ParetoHealth captive.

What is a captive?

Captive insurance is a group self-insurance arrangement owned by Members. Captive Members pool resources to self-insure collectively. Pooling risk means that one Member’s high claims are offset by others with lower claims, reducing year-to-year cost volatility for all Members.

Because the captive is Member-owned, profits (if any) from the risk pool are reinvested or returned to Members, creating added value beyond typical insurance. Members also share in any losses.

What is an employee benefits captive?

An employee benefits captive is a captive insurance arrangement used to manage and finance employee benefit programs.

Upside:

-

-

-

- Reduced volatility compared to traditional self-funding: When combined with stop-loss insurance that caps catastrophic claims, the captive serves as a shock absorber for healthcare costs, absorbing volatility from mid-sized claims while protecting against large, unexpected claims. This keeps healthcare costs more stable and predictable over time.

-

-

-

-

-

- Potential healthcare cost savings: When claims are lower than expected, the savings generated by the ParetoHealth captive Members are kept by the Members, rather than retained by an insurance company. When claims are higher than expected, costs within the captive are shared across the group.

-

-

-

-

-

- Scale and purchasing power: ParetoHealth is the largest and fastest growing community of its kind (3x larger than anyone else). This scale delivers risk protection and negotiation leverage that midsize employers can’t get on their own.

-

-

Tradeoffs:

-

-

-

- ParetoHealth captives are built for employers who take a long-term view. The captive model might not be the right fit for employers who make decisions one year at a time based solely on renewal rates. It requires a shift from reacting annually to thinking strategically across multiple years. For those ready to engage, commit, and think like a CFO, the rewards are meaningful: greater control, reduced volatility, and lower costs over time.

-

-

What is self-funding with ParetoHealth captive?

ParetoHealth unites employers with 50-1,000 employees into one strong, like-minded community, unlocking a better way to reduce volatility and lower overall health benefits costs.

In healthcare, scale matters. As the largest and fastest growing community of its kind, ParetoHealth’s scale gives employers greater negotiating power, stabilizes the risk pool, and unlocks access to cost-saving and benefit-enhancing solutions that would otherwise be out of reach.

Employers who self-fund with a ParetoHealth captive stop reacting to unexpected annual health insurance premium increases. Instead, they focus on building and executing a multiyear strategy to reduce healthcare costs.

Fully insured health plans shouldn’t be the default

Choosing the right health plan funding model is one of the most important financial decisions a midsize employer makes. Yet, many stick with a fully insured health plan simply because it feels familiar and predictable.

However, midsize employers don’t have to feel stuck in fully insured health plans. The path forward begins with evaluating alternative funding models and choosing the funding strategy that best supports business goals.