The landscape of health insurance is complex, and self-funding is no exception.

We can (and do) talk all day about the benefits of self-insurance. But not all self-insured plans are the same, especially when it comes to stop-loss insurance – one of self-funding’s biggest differentiators.

Stop-loss Insurance in a Nutshell

Medical stop-loss insurance protects against catastrophic, unpredictable, or numerous claims.

Stop-loss coverage is critical for self-insured employers – without it, they’re 100% liable for all losses. While an employee’s broken foot might be manageable, the financial impact of health events like cancer can be staggering, often going beyond the means of midsized businesses.

Traditional Stop-loss Plans (and Why They Don’t Work for Midsize Employers)

Don’t be fooled: Ordinary stop-loss policies are still volatile, thanks in large part to a process known as “lasering.”

Lasering is a practice that isolates high-risk individuals and assigns them a higher stop-loss threshold (deductible) than other employees.

Consider the following scenario.

An employer has a stop-loss policy with $400K in premium. During the year, one of the employers under this plan develops cancer, and their medical costs total $2M. The carrier pays these claims, but if they were to continue paying for future claims (and these claims rarely last for less than a year), then it would take 5 years for the stop-loss premium to support those claims.

Since an insurance carrier is not in the business of losing significant amounts of money, and their policies are written for one year at a time, they’re forced to shift the risk onto the employer (via a laser) or increase the premium that they collect.

If an employer opts out of the laser and their stop-loss policy doesn’t have a no new laser/rate cap provision, then their renewal can be hundreds of percentage points over the previous year.

The typical percentage of stop-loss premium in a self-funded policy is only around 20-30% of total costs – with other costs coming from administration and the actual payments for claims. So, a sizable premium increase can turn smaller employers away from traditional self-funding.

This means the employer is faced with either paying for these claims themselves or accepting an unsustainable increase in their stop-loss premium.

Is there a way out of this problem?

In the traditional market, there isn’t. This is precisely why we’ve created the group captives at ParetoHealth: They provide greater protection than any other stop-loss structure on the market.

A Robust Stop-loss Structure

ParetoHealth provides employers with multi-year stop-loss coverage – the only one of its type in the market. When employers join us, they get a 30% rate cap on stop-loss renewals, year over year, and no new lasers as long as they’re in our program. If we factor in the usual portion stop-loss premium costs, this is approximately equivalent to a 7.5% fully-insured renewal.

And that’s the highest renewal we’ve ever given in our entire history.

We make this work by block underwriting, or treating the entire captive as a single purchaser. Let’s build on our earlier example: If the $2M cancer claim is part of a block worth a total of $1B+ (pooling all the premiums together), then the economic realities of the carrier suddenly begin to look very different.

Individual policies are written to distribute the impact of large claims over the entire entity. When there are more than 2,000 employers in the captive, that can mean that individual large claims only require a slight increase at renewal.

This does mean that the price of stop-loss coverage is slightly higher (1-2%) in a good year, but it also means that the impact of a bad year is potentially hundreds of percentage points less than it would be if the policy were written for one employer.

Good Years Vs. Bad Years

We’re big believers in multi-year stop-loss coverage (if you couldn’t already tell).

Of course, there will be good years. Sometimes, there will be bad years.

Our data shows that most employers will experience one “bad” claims year every five years. It’s not a question of if there will have a bad year, it’s when. Worse, if a large, multi-year claim appears on an employer’s plan, they could be dealing with the fallout for many years to come.

That’s a catastrophe that employers can’t afford.

We can’t predict when a potentially bad year will occur. But a top-tier self-funded plan like ours will always take this into account. With ParetoHealth, you spend a few more percentage points during a good year to pay hundreds of percentage points less during a bad one.

What does this mean – and how do we make it happen?

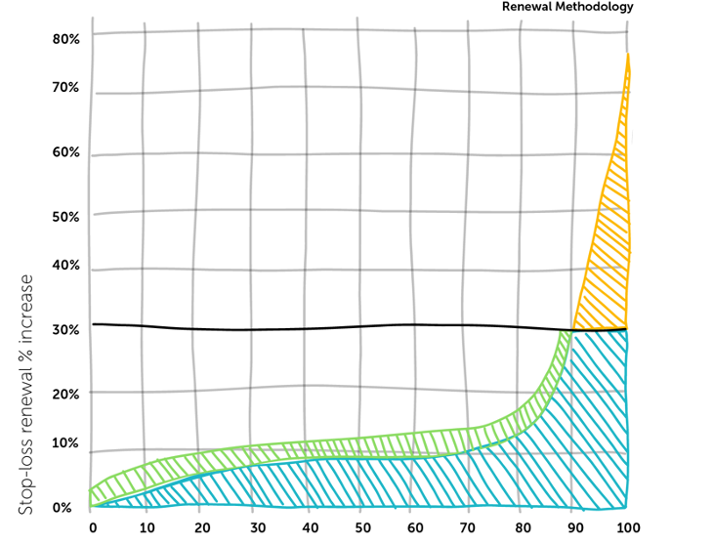

Let’s look at the graph below.

ParetoHealth’s Renewal Methodology

Orange represents employers that had poor claims experiences this year. Instead of sticking them with sky-high renewals, we spread the premium increases (in green) across the entire block. No one employer feels the impact of a terrible year.

We’re all in this together. We understand and prepare for the inevitable: At some point, every employer will have a less-than-stellar year. Under our captive model, paying a little more annually means that other employers in this self-funded pool can easily support this employer when their bad year comes.

It’s a game-changing approach for many small and midsized businesses.

Affording a large, ongoing claim – one that significantly affects renewals for years – has long been out of the question. But with ParetoHealth, and a minimal investment through a small renewal increase in good years, employers can greatly mitigate their bad ones.

Making the Stop-loss Switch

Stop-loss coverage is a necessity under self-funded plans. But you have the power to choose your structure.

It’s clear that the traditional approach has never really worked in favor of employers. If you’re interested in breaking the 12-month cycle and switching to a more sustainable solution, then ParetoHealth is here to help you there.

Contact us to see what you can save.

Earlier this week, a Johnson & Johnson employee brought a lawsuit alleging the company breached its fiduciary duties by not adequately managing healthcare costs, resulting in their ERISA plans and plan beneficiaries overpaying for healthcare expenses. The heart of this lawsuit is a question of fiscal responsibility – to what degree must a company manage shared healthcare costs?

The argument is that J&J has an affirmative duty to act in the best interests of the plan and plan participants. This duty was allegedly breached through poor oversight of their pharmacy benefit manager (PBM) vendor, which led to millions of dollars of overspending.

I’m not an attorney and will leave it to the legal experts to dissect the merits of this case, but I am drawn to the broader conversation it sparks: namely, the critical role employers play in handling healthcare expenses. This transcends dollars and cents: it’s about the trust and reliance employees place in their employers to safeguard their interests. Regardless of the outcome of this case, companies must think carefully about how they approach and administer healthcare benefits.

Employers

Employers must be more diligent in exploring ways to monitor and reduce costs. Gone are the days of autopilot renewals and planning only for the next twelve months. I think this will be particularly true for employers that are “fully insured.”

Fully insured employers pay a fixed monthly premium to a health insurer. Once a year, the price is adjusted (almost always upwards) based on various factors. In some ways, a fully insured plan is like hitting “the easy button.” While the simplicity may have its charm, fully insured plans are also fairly opaque. How can you ensure wise spending if you’re in the dark about the details of something as important as your PBM?

I feel for employers. Our healthcare system is complex, and managing costs isn’t always straightforward. Many employers don’t have the resources to do this effectively, yet they are accountable. They must invest time and effort, and they must have competent advisors.

The principles in this case reverberate beyond the courtroom, underscoring the value employees place on their benefits. The caliber of benefits can impact recruiting, job performance, job satisfaction, and employee retention. Given the complexity of benefits, employees expect their employers to advocate for their best interests – in fact, this lawsuit reflects that these expectations have never been higher.

Brokers

This case will also focus a spotlight on insurance brokers. The responsibility for cost management will cascade down, with employers holding their advisors to account. This could be transformative and a great thing.

Too many insurance brokers view their role as delivering a spreadsheet of one-year quotes. The time has come for a more strategic, multi-year approach to combat rising and unpredictable costs.

At ParetoHealth, we’re committed to standing side-by-side with our captive members in the battle to reduce the cost and volatility of health insurance. We are privileged to work with brokers who are truly consultants, and who are committed to their clients’ best interests.

This lawsuit could herald a decisive moment, prompting employers and brokers alike to choose where they stand. At ParetoHealth, we’re ready to welcome a new wave of allies to join us on the ‘right side of the fight.’

Season 2 of “80/20 with ParetoHealth” launches with a discussion on the state of medical literacy and care navigation (aka care coordination) today. Justin Holland and Doug Morse-Schindler of HealthJoy explain how technology can build bridges in the massive healthcare ecosystem and where it falls short. We also rant about the pitfalls of self-diagnosing on Google and the immense potential of a revenue stream tied to sleepless nights caused by WebMD. Finally, we learn that building appropriate and valuable tech solutions requires layers of thought, partnerships, and room for customization. Simply put, we confirm that healthcare is never one-size-fits-all, not even in the digital space.

When was your last bad dream?

You might not realize it, but you’re living in one today: Healthcare costs in the U.S. currently make up more than 40% of global healthcare spending.1 It’s a growing problem – one that can’t be solved by doing what’s always been done.

Let’s take a deep dive into why and what we can do to fix it.

The Real Cost of Healthcare

America’s Prescription Drug Problem

Prescription drug costs are a major, but unsurprising, contributor to this problem.

On average, each American spends $1,443 on prescription drugs, compared to $749 per person in other countries.2 In Europe, drugs are priced by the government based on the benefit the drug will have for patients, but that’s not the case here.

For American manufacturers, the cost of making a drug is often much less than the price they charge patients – and the reason why is two-fold: to make a profit and cover the high cost of testing and releasing the drug.3

Critical Care at Sky-high Prices

Healthcare services play a big role in this nightmare, too.

For example, an MRI in the UK costs approximately $4502. In the U.S., the cost of healthcare services can vary wildly based on location. The average patient doesn’t know how much a service costs – that is, until they get the bill from their insurance company.

Public and private insurers in the U.S. have various out-of-pocket costs, funding sources, and rules, so it takes a variety of billing professionals to process claims. These billers must be trained and paid, and that’s reflected in premium prices.3

This leads to a bigger problem.

According to Harvard Magazine,4 nearly half of all Americans have delayed healthcare due to its high cost. Patients end up paying more in the long run, as their conditions advance and become harder to treat and cure. If preventive care were more affordable and accessible, patients could save their money and their lives.1

It’s a vicious cycle.

Americans underspend on primary care but overspend on prescription and hospital costs. Due to these two factors, employers’ costs rise year over year. So, what happens? Employers start reducing benefits and shifting costs to their employees, of course.

Combined with inflation, this is crushing middle America: Roughly 100 million Americans have racked up nearly $200 billion in medical debt. What’s more, this debt drives around half a million people to declare bankruptcy each year.5

No, this isn’t just a bad dream. It’s the reality too many Americans are living today.

The Risk of Traditional Plans

Traditional plans only multiply the problem.

Under a fully-insured healthcare plan, employers have little control over plan design. These off-the-shelf plans are inflexible and leave few options for employers to personalize their benefits to meet the specific needs of their employees.

The whole point of insurance is clear-cut in theory, but complex in reality: paying to shift risk from one party to another. But this risk largely falls onto the employer – partly due to the fact that health insurance isn’t really insurance.

In a fully-insured plan, you pre-pay for any claims that occur during a particular year. If you overpay at the beginning, then the carrier pockets the difference. If you underpay, you get a huge renewal. We refer to this as deferred, not insured: This plan involves you transferring all your costs (but no savings) forward by twelve months.

Traditional self-insured plans don’t fare much better.

Simply put, these plans are too risky for the smaller employer. Even if you’ve purchased stop-loss insurance to protect yourself, a large, multi-year claim can lead to a laser and/or huge premium increases.

The ParetoHealth Solution

ParetoHealth’s mission is to make self-insurance affordable, accessible, and less risky for small and mid-sized businesses. We also believe in patients getting the care they need when they need it – at the right price.

How ParetoHealth’s Program Works

When a small or mid-sized business chooses ParetoHealth’s employee benefits captive program, they join a community of like-minded employers committed to offering better employee benefits, reducing waste, and innovating healthcare on their own terms.

We refer to this as a coalition of the willing – a group of employers that grew tired of the status quo. They stopped doing the same thing and expecting different results. They grabbed the bull by the horns because changing healthcare for your organization means peeling back the onion and proactively managing claims.

Members own the captive.

The captive operates on a large scale with a large volume of stop-loss insurance, and so, can offer true multi-year protection from large and ongoing claims. Due to the program’s size and scale, it can offer superior terms such as rate caps and no new lasers, which are unavailable to most smaller employers purchasing stop-loss. For the first time, self-insurance becomes a viable option for these employers.

Members are in control of their plan, and they have the power to:

- • Choose their network

- • Select their plan design and TPA

- • Cut costs and improve coverage

- • Offer innovative healthcare programs, including:

- • Prescription drug cost control

- • Care coordination services

- • Oncology management

In this way, we can align the incentives of employees to get the best possible care with the incentives of the employers to provide cost-effective options.

The Industry’s Strongest Stop-loss Policy

ParetoHealth’s Members have access to the strongest stop-loss structure in the industry.

This means that they’re protected against large, ongoing claims and pay small claims as they happen without overspending or deferring costs.

But that’s not all: There is strength in numbers in the community, which creates a long-term buffer against stop-loss premium increases. Thousands of employers have access to their own data, they’re proactively engaged in cost-containment solutions, and they’re providing their employees with cost-effective, quality care.

Here, positive results aren’t difficult to come by.

Integrated Cost Management Platform

Managing healthcare costs is central to what we do.

ParetoHealth’s Integrated Cost Management (ICM) platform makes that happen.

Medical Cost Intelligence

ParetoHealth analyzes Members’ claims data to identify savings opportunities:

- • High-impact interventions: Our care-coordination partners look for signs of potential high-cost care needs such as cancer and neonatal events, then intervene to connect employees with providers who can deliver the best care at the lowest cost.

- • Data-driven playbooks: Our analytics partners and in-house experts work together to create playbooks with potential “plays” to cut costs. Members then work with their benefits consultants to implement these easy, personalized strategies.

Pharmacy Cost Intelligence

Pharmacy benefits can represent 20-25% of a program’s costs. With pharmacy prices on the rise, we continuously look for ways our Members can save – and they do: Members have potential annual savings of 25-30%.

- • Formulary management: ParetoHealth’s formularies support low, medium, and high drug cost-control approaches. Our experts actively look for savings opportunities.

- • Pharmacy benefits management advisory: Our experts negotiate pharmacy benefits manager (PBM) contracts and monitor their performance to ensure they comply with preferred pricing and rebate guarantees.

- • Specialty drug management: We can carve specialty drugs out of Members’ PBM contracts and use advanced analyses of clinical value, appropriate use, and other factors to reduce claims for very high-cost drugs.

- • Pharmacy playbooks: These personalized strategies reduce costs by replacing brand-name drugs with generics, finding low-cost therapies for high-cost medical conditions, and ensuring drugs are claimed through the pharmacy benefit – and more.

See What You Can Save

The nightmare price of American healthcare isn’t going to change anytime soon.

The good news is this: ParetoHealth can help you wake up, break out of the 12-month insurance cycle, and gain true control of your plan. Each day, we work hard to help small and mid-sized employers reduce the costs – not the quality – of their employee healthcare benefits.

Ready to get on the path to better benefits? Contact us to see what you can save.

References

1. World Health Organization. (2021). Global expenditure on health: Public spending on the rise? Retrieved from https://apps.who.int/iris/bitstream/handle/10665/350560/9789240041219-eng.pdf#page=11

2. Investopedia. (2022). 6 reasons why healthcare is so expensive in the U.S. Retrieved from https://www.investopedia.com/articles/personal-finance/080615/6-reasons-healthcare-so-expensive-us.asp

3. Porretta, A. (2022). Why is health insurance so expensive? eHealth. Retrieved from https://www.ehealthinsurance.com/resources/affordable-care-act/obamacare-premiums-unaffordable-for-many-middle-income-people-in-2019

4. Cutler, D. (2020). The world’s costliest health care and what America might do about it. Harvard Magazine. Retrieved from https://www.harvardmagazine.com/2020/05/feature-forum-costliest-health-care

5. Bedayn, J. (2023). States confront medical debt that’s bankrupting millions. Washington Post. Retrieved from https://www.washingtonpost.com/politics/2023/04/12/medical-debt-legislation/0198c70e-d995-11ed-aebd-3fd2ac4c460a_story.html

My role at ParetoHealth is to help employers and brokers find the most valuable benefits packages for their company and clients. Simple enough, right?

The reality is a bit more complex. A key function of my success hinges on educating people. However, before I can talk about ParetoHealth’s advantages, I need to establish my credibility. I understand that my affable disposition lends itself to your run-of-the-mill sales guy, but I assure you, I’m not out there to smash my quota and get a bonus. I can’t sell something I don’t truly believe in myself.

I believe there’s a better way to obtain the quality benefits that employees deserve, and it doesn’t have to come at a cost that shortchanges the future of mid-sized businesses.

That’s why I’m taking this opportunity to address one of the most common misconceptions: transitioning to a self-insured model is too difficult. Many think it’s an endeavor that rivals a Greek epic poem, with all parties at the mercy of an overcomplicated and tedious process.

TL;DR – it’s not.

Every employer’s situation is different, from scale to location. However, I’ve found what makes employers wary of self-funding generally comes from one of three myths:

Myth 1: It’s too complicated.

Reality: While our turnkey cost-management approach might be disruptive for the current state of the archaic insurance industry, making the transition from your current carrier to ParetoHealth is seamless. Most of our Members see no interruptions – major or minor – to their existing benefit structure. Employees can stick with almost every provider they know and trust without restrictions. The one big change: Members gain access to an enhanced benefits experience.

They enjoy the freedom of creating plans customized to their needs – or they can keep the exact plan designs they currently have in place. We make it easy because we understand that keeping employees happy is just as important as keeping them healthy.

But this is insurance – so surely implementation means a mountain of paperwork, red tape, and endless meetings?

Generally speaking, this part of the process is over in two or three brief meetings to sign some documents. It’s that easy.

Myth 2: It’s too risky

Reality: ParetoHealth’s mission is to remove the commonly associated risks of self-insurance to the benefit of small to medium-sized businesses.

Members of our captives are closely vetted to make sure only the right companies with the right leadership teams are joining. Then, after they join, our size and scale mean that we protect Members from unpredictable catastrophic claims better than anyone in the industry. This is how ParetoHeath mitigates the risk of self-funding.

Ironically, the real risk comes from remaining fully insured. Not only are you powerless to prevent big claims, but when one does happen (because it’s inevitable), your fully insured renewal will be through the roof! That terrible renewal will be your burden to bear – indefinitely. Because your current premium is the launching point for calculating your next renewal. In that way, the costs snowball, and you lose ground each year, and there’s no way to make up for it. It’s a financial catastrophe. So the sooner you switch to self-insurance, the better – which brings us to our next myth…

Myth 3: It’s not a good time

Reality: If you’re operating under a fully insured model, whether you had a good or bad year of claims, your annual premium will always increase. In a good year, your reward is a 2% increase…and that equates to a ton of profit for your carrier. On the other hand, if you’re running poorly and think, “I’ll wait until my claims clean up to move to self-funding,” I hate to be the bearer of bad news, but there’s simply no feasible way anyone can predict all the illnesses or prevent another catastrophic claim from happening.

What happens during month 13 if you stay fully-insured for another year? The scenario of the prior year repeats.

Once you step out from the blind alley that a fully-insured model kept you cornered in, you begin to see a bigger picture. You can build long-term strategies with predictable renewal rates and room to grow your business. NOW is always the best time to join ParetoHealth and get the protections and predictability that have alluded you for all these years.

Like all my colleagues at ParetoHealth, I take pride in my work and am here to help. I know the people behind the numbers. I see that HR director’s daughter who needs a monthly prescribed injection, I see the line worker’s wife battling cancer, and I will do whatever I can to ensure they have access to the best care possible. No matter how often I help unpack the same concerns for people, I still find purpose in it because, like the rest of my colleagues at ParetoHealth, I’m in this for the greater good.

As we approach the new year, now is the right time to review the healthcare trends likely to impact your employee benefits. This can be daunting, so we’ve gathered the data for you.

Let’s dive right in.

The 2023 Global Medical Trends Survey reports that the cost of healthcare on a global level will increase at the highest rate in 15 years1. In North America, the Segal Group predicts that health insurance premiums will increase by 7% or 8% rather than the usual pace of 6% per year2. The survey cites inflation and increased healthcare utilization as the driving forces.

As we emerge from the COVID-19 pandemic, insurers are concerned about consumers’ shifting relationships with healthcare. Many postponed care during the height of the pandemic, so utilization is higher than usual, as patients return to the doctor for more than just an annual checkup and face the consequences of delayed care.

Seventy-five percent of insurers polled said they are concerned about providers overreacting and recommending too many services. But that’s not all. Fifty-two percent worry about their members’ health habits, and 50% cited the underuse of preventive services as a cause of rising costs.1

A 10% increase in overall prescription drug costs is another troublesome circumstance facing employers, mainly driven by medical innovation. Expensive drugs like gene therapies and new HIV treatments emerged on the market this year (which our CEO Andrew Cavenagh predicted in his first blog post). These drugs provide life-altering benefits to those who receive them, but the release of generics, which would help to control market costs, has not kept pace2.

The Inflation Reduction Act will allow Medicare to negotiate the prices of ten common drugs, which will bring some relief to consumers. Still, this changes the economics of certain drug products, and insurers will look to any savings as opportunities to build in profit. In turn, you can expect pharmaceutical companies to hike prices for private insurance companies2.

Employers will have to balance increasing costs with salary demands—all in the midst of a possible recession. In addition, the labor market remains fairly tight, and rising healthcare costs may eat into the funds needed to offer competitive salaries.

Coverage gaps may impact employers’ Diversity, Equity, and Inclusion (DEI) initiatives, as certain gaps, such as fertility treatments, midwives, and HIV/AIDs treatments, tend to be more statistically prevalent among specific segments of the population. However, as noted in the survey report, “Employers have an opportunity to work with their consultants and brokers to bridge these coverage gaps and help deliver more equitable health outcomes across different employee groups.”2 Bridging coverage gaps always has an associated financial cost. Still, employers may have difficulties hiring and retaining employees when they ignore these gaps.

It is not all bad news. The No Surprises Act was enacted this year, and early indications are it effectively reduces unexpected out-of-network hospital charges2. Telehealth is also becoming increasingly valuable; it was ranked as the second-best cost management tool, gaining traction from last year1.

Other key findings are that cancer is the number one condition affecting medical costs, followed by musculoskeletal and cardiovascular disorders. Mental and behavioral health disorders are ranked the fourth most common by incidence and claims and are expected to keep climbing1.

So, what should employers do with this information?

If you’re worried that members are underutilizing their primary care and preventive services, find ways to incentivize the use of those benefits. Since mental and behavioral health claims are on the rise, make sure your benefits provide these resources at the best value to your employees. If there are gaps in your coverage, especially if they relate to DEI initiatives, address them to prevent future hiring issues and legal troubles. Overall, think about how to personalize your benefits to meet the specific needs of your employees.

Stop “just” buying insurance and start delivering great healthcare benefits and resources to your employees.

To mitigate increasing prices, employers should prioritize cost-containment solutions. Fortunately for you, cost containment has been our focus since ParetoHealth’s inception. We believe it’s crucial to know where your healthcare dollars are going and analyze trends to ensure that you are spending wisely while not compromising access or quality of care.

If you’re fully insured, and don’t have visibility into your claims data, now is the time to change that. Being self-insured and part of our captive allows you to make customized, long-term strategies to help weather the blows of inflation and medical trends.

Start the new year right. Learn more about making the essential switch here.

References

1. WTW. (2022). 2023 Global Medical Trends Survey. Retrieved from https://www.wtwco.com/en-MY/Insights/2022/10/2023-global-medical-trends-survey-report

2. Payne, D. (2022). What will happen with health costs in 2023? Kiplinger. Retrieved from https://www.kiplinger.com/personal-finance/inflation/605084/what-will-happen-with-health-costs-in-2023

No matter where you are in the world, you probably know someone with diabetes. In fact, research suggests that in the United States alone, diabetes affects an estimated 114.4 million Americans, including those that are diagnosed, prediabetics, and undiagnosed diabetics.1 These numbers are expected to grow, with at least 15-30% of pre-diabetics developing type 2 diabetes within 5 years.8 If current trends continue, 1 in 3 Americans will develop diabetes in their lifetimes.2

The consequences continue well after the disease develops. Over a third of people with diabetes develop issues with their blood pressure and cholesterol.3 When left unmanaged, these patients can undergo more serious conditions like heart disease, stroke, kidney failure, lower limb amputations, and adult-onset blindness.4

The costs attached to the disease are also alarming. In 2017, the estimated cost of diabetes in the United States was $327 billion, including $237 billion for direct medical costs and $90 billion in indirect costs for disability, time off from work, and premature death.5 The contribution to overall healthcare costs is so significant that if health center patients with uncontrolled diabetes could reduce their HbA1c (glycated hemoglobin linked to sugar) by just 1.25%, the potential savings in medical costs could exceed $3.44 billion over three years.6

The truth is, diabetes can severely impact a person’s quality of life, and in some cases, cut It short altogether. With alarming numbers to back this up, you could consider diabetes as an expensive, worldwide epidemic.

Which means that the time to act is now.

Fortunately, there is a lot you can do to target this problem directly and indirectly. Raising awareness, providing actionable steps, and actively supporting employees in the workplace is an excellent place to start.

Here’s a list of various tools that your organization can implement to combat type 2 diabetes at work7. As you safeguard health, you also ease what is likely a significant burden on your overall healthcare spending and have a chance to dramatically improve quality of life.

1. Conducting internal health surveys

To form a baseline for your population of employees, use employee health surveys to identify the percentage of workers touched by the diagnosis or at risk of a diagnosis. The results of this survey can help you recognize those that have received appropriate screening for type 2 diabetes and educate individuals that may need direction towards counselling or follow up screenings like blood glucose testing.

If you include lifestyle concerns like physical activity, nutrition, and obesity as part of your survey, this will give you a holistic perspective of your employees’ health.

Overall, creating this baseline should aid in designing the necessary programs for your employees.

2. Developing employee wellness programs

Wellness programs in the workplace targeting lifestyle improvements like good nutrition, weight management, and increased physical activity can directly address type 2 diabetes by delaying the onset of the disease.

According to clinical trials from 2001 by the National Diabetes Prevention Program, “Modest weight loss and physical activity substantially reduced progression to type 2 diabetes among adults who were at very high risk.” Additionally, improved nutrition plays a significant role in helping people cut their risks. In fact, the American Diabetes Association recommends that even people with prediabetes should be counseled on the same lifestyle changes.

So, engaging your employees in these activities could substantially affect the outcomes of the disease.

3. Education

To truly target the disease, education is crucial. Consider self-management education, disease management awareness, or training–a principal step in improving diabetes care and quality of life.

By hosting educational opportunities for your employees on certain behaviors like healthy eating, movement, and monitoring blood sugar, you encourage a collaborative process in which educators help workers with diabetes or at risk for it gain the knowledge, problem-solving, and coping skills needed to deal with the disease and its related conditions.

4. Access to care and disease management

Whether by providing on site flu shots (diabetics have higher susceptibility to influenza), or making sure each individual is connected to the right team of experts, you should consider having a unique plan of action for diabetes-specific care.

For example, you can utilize a coordinated care team that educates and helps prevent complications and development of co-occurring conditions that may arise with the diagnosis.

In general, guidance, direction, and encouragement from the workplace has a significant impact on handling the disease.

More than likely, diabetes is already playing a significant role in your employees’ overall health. For just that reason alone, it is worth considering taking the extra mile to prevent and manage it. Not only does that improve your employees’ health, but it can also support significant savings.

Lifestyle diseases tend to have a duality to them—when left unchecked they lead to a plethora of other problems, but when prevented or managed correctly and aggressively, this is key to a happier and healthier world, both in and out of the workplace.

Sources:

1. CDC. National Diabetes Statistics Report, 2017 – Estimates of Diabetes and Its Burden in the United States. 2017. https://www.cdc.gov/diabetes/pdfs/data/ statistics/national-diabetes-statistics-report.pdf.

2. Boyle JP, Thompson TJ, Gregg EW, et al. Projection of the year 2050 burden of diabetes in the US adult population: dynamic modeling of incidence, mortality, and prediabetes prevalence. Popul Health Metr. 2010;8:29.

3. American Diabetes Association. Standards of Medical Care in Diabetes—2019 Abridged for Primary Care Providers. Clin Diabetes. 2019;37(1):11-34. doi:10.2337/cd18- 0105

4. 3. ODPHP. Diabetes | Healthy People 2020. Healthy People 2020. https://www.healthypeople.gov/2020/topics-objectives/topic/diabetes. Accessed October 4, 2019.

5. American Diabetes Association. Economic Costs of Diabetes in the U.S. in 2017. Diabetes Care. 2018;42(10):dci180007. doi:10.2337/dci18-0007

6. Fitch A, Everling L, Fox C, et al. Health Care Guidelines – Prevention and Management of Obesity for Adults. Inst Clin Syst Improv. 2013;Sixth Edition. https://www. healthpartners.com/ucm/groups/public/@hp/@public/documents/documents/cntrb_037112.pdf. Accessed October 8, 2019.

7. https://www.cdc.gov/workplacehealthpromotion/health-strategies/diabetes/interventions/programs.html

8. CDC. National Diabetes Prevention Program: Working Together to Prevent Type 2 Diabetes. The Diabetes Prevention Program. https://www.cdc.gov/diabetes/ prevention/pdf/NDPP_Infographic.pdf.