The landscape of health insurance is complex, and self-funding is no exception.

We can (and do) talk all day about the benefits of self-insurance. But not all self-insured plans are the same, especially when it comes to stop-loss insurance – one of self-funding’s biggest differentiators.

Stop-loss Insurance in a Nutshell

Medical stop-loss insurance protects against catastrophic, unpredictable, or numerous claims.

Stop-loss coverage is critical for self-insured employers – without it, they’re 100% liable for all losses. While an employee’s broken foot might be manageable, the financial impact of health events like cancer can be staggering, often going beyond the means of midsized businesses.

Traditional Stop-loss Plans (and Why They Don’t Work for Midsize Employers)

Don’t be fooled: Ordinary stop-loss policies are still volatile, thanks in large part to a process known as “lasering.”

Lasering is a practice that isolates high-risk individuals and assigns them a higher stop-loss threshold (deductible) than other employees.

Consider the following scenario.

An employer has a stop-loss policy with $400K in premium. During the year, one of the employers under this plan develops cancer, and their medical costs total $2M. The carrier pays these claims, but if they were to continue paying for future claims (and these claims rarely last for less than a year), then it would take 5 years for the stop-loss premium to support those claims.

Since an insurance carrier is not in the business of losing significant amounts of money, and their policies are written for one year at a time, they’re forced to shift the risk onto the employer (via a laser) or increase the premium that they collect.

If an employer opts out of the laser and their stop-loss policy doesn’t have a no new laser/rate cap provision, then their renewal can be hundreds of percentage points over the previous year.

The typical percentage of stop-loss premium in a self-funded policy is only around 20-30% of total costs – with other costs coming from administration and the actual payments for claims. So, a sizable premium increase can turn smaller employers away from traditional self-funding.

This means the employer is faced with either paying for these claims themselves or accepting an unsustainable increase in their stop-loss premium.

Is there a way out of this problem?

In the traditional market, there isn’t. This is precisely why we’ve created the group captives at ParetoHealth: They provide greater protection than any other stop-loss structure on the market.

A Robust Stop-loss Structure

ParetoHealth provides employers with multi-year stop-loss coverage – the only one of its type in the market. When employers join us, they get a 30% rate cap on stop-loss renewals, year over year, and no new lasers as long as they’re in our program. If we factor in the usual portion stop-loss premium costs, this is approximately equivalent to a 7.5% fully-insured renewal.

And that’s the highest renewal we’ve ever given in our entire history.

We make this work by block underwriting, or treating the entire captive as a single purchaser. Let’s build on our earlier example: If the $2M cancer claim is part of a block worth a total of $1B+ (pooling all the premiums together), then the economic realities of the carrier suddenly begin to look very different.

Individual policies are written to distribute the impact of large claims over the entire entity. When there are more than 2,000 employers in the captive, that can mean that individual large claims only require a slight increase at renewal.

This does mean that the price of stop-loss coverage is slightly higher (1-2%) in a good year, but it also means that the impact of a bad year is potentially hundreds of percentage points less than it would be if the policy were written for one employer.

Good Years Vs. Bad Years

We’re big believers in multi-year stop-loss coverage (if you couldn’t already tell).

Of course, there will be good years. Sometimes, there will be bad years.

Our data shows that most employers will experience one “bad” claims year every five years. It’s not a question of if there will have a bad year, it’s when. Worse, if a large, multi-year claim appears on an employer’s plan, they could be dealing with the fallout for many years to come.

That’s a catastrophe that employers can’t afford.

We can’t predict when a potentially bad year will occur. But a top-tier self-funded plan like ours will always take this into account. With ParetoHealth, you spend a few more percentage points during a good year to pay hundreds of percentage points less during a bad one.

What does this mean – and how do we make it happen?

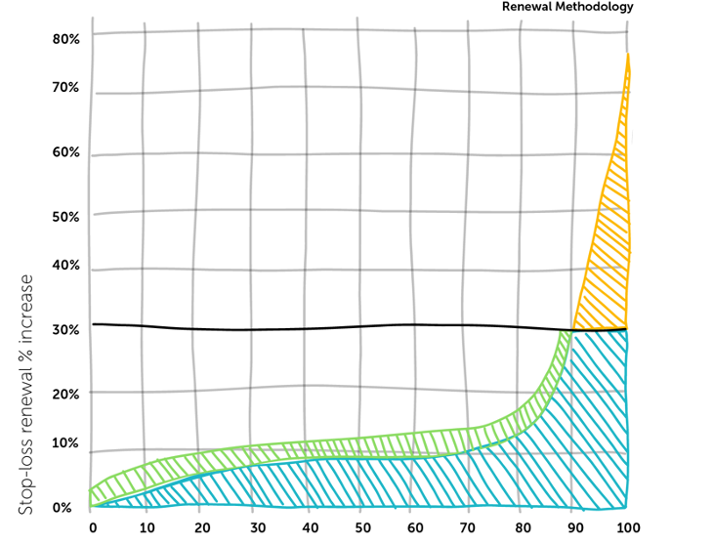

Let’s look at the graph below.

ParetoHealth’s Renewal Methodology

Orange represents employers that had poor claims experiences this year. Instead of sticking them with sky-high renewals, we spread the premium increases (in green) across the entire block. No one employer feels the impact of a terrible year.

We’re all in this together. We understand and prepare for the inevitable: At some point, every employer will have a less-than-stellar year. Under our captive model, paying a little more annually means that other employers in this self-funded pool can easily support this employer when their bad year comes.

It’s a game-changing approach for many small and midsized businesses.

Affording a large, ongoing claim – one that significantly affects renewals for years – has long been out of the question. But with ParetoHealth, and a minimal investment through a small renewal increase in good years, employers can greatly mitigate their bad ones.

Making the Stop-loss Switch

Stop-loss coverage is a necessity under self-funded plans. But you have the power to choose your structure.

It’s clear that the traditional approach has never really worked in favor of employers. If you’re interested in breaking the 12-month cycle and switching to a more sustainable solution, then ParetoHealth is here to help you there.

Contact us to see what you can save.

Earlier this week, a Johnson & Johnson employee brought a lawsuit alleging the company breached its fiduciary duties by not adequately managing healthcare costs, resulting in their ERISA plans and plan beneficiaries overpaying for healthcare expenses. The heart of this lawsuit is a question of fiscal responsibility – to what degree must a company manage shared healthcare costs?

The argument is that J&J has an affirmative duty to act in the best interests of the plan and plan participants. This duty was allegedly breached through poor oversight of their pharmacy benefit manager (PBM) vendor, which led to millions of dollars of overspending.

I’m not an attorney and will leave it to the legal experts to dissect the merits of this case, but I am drawn to the broader conversation it sparks: namely, the critical role employers play in handling healthcare expenses. This transcends dollars and cents: it’s about the trust and reliance employees place in their employers to safeguard their interests. Regardless of the outcome of this case, companies must think carefully about how they approach and administer healthcare benefits.

Employers

Employers must be more diligent in exploring ways to monitor and reduce costs. Gone are the days of autopilot renewals and planning only for the next twelve months. I think this will be particularly true for employers that are “fully insured.”

Fully insured employers pay a fixed monthly premium to a health insurer. Once a year, the price is adjusted (almost always upwards) based on various factors. In some ways, a fully insured plan is like hitting “the easy button.” While the simplicity may have its charm, fully insured plans are also fairly opaque. How can you ensure wise spending if you’re in the dark about the details of something as important as your PBM?

I feel for employers. Our healthcare system is complex, and managing costs isn’t always straightforward. Many employers don’t have the resources to do this effectively, yet they are accountable. They must invest time and effort, and they must have competent advisors.

The principles in this case reverberate beyond the courtroom, underscoring the value employees place on their benefits. The caliber of benefits can impact recruiting, job performance, job satisfaction, and employee retention. Given the complexity of benefits, employees expect their employers to advocate for their best interests – in fact, this lawsuit reflects that these expectations have never been higher.

Brokers

This case will also focus a spotlight on insurance brokers. The responsibility for cost management will cascade down, with employers holding their advisors to account. This could be transformative and a great thing.

Too many insurance brokers view their role as delivering a spreadsheet of one-year quotes. The time has come for a more strategic, multi-year approach to combat rising and unpredictable costs.

At ParetoHealth, we’re committed to standing side-by-side with our captive members in the battle to reduce the cost and volatility of health insurance. We are privileged to work with brokers who are truly consultants, and who are committed to their clients’ best interests.

This lawsuit could herald a decisive moment, prompting employers and brokers alike to choose where they stand. At ParetoHealth, we’re ready to welcome a new wave of allies to join us on the ‘right side of the fight.’

When was your last bad dream?

You might not realize it, but you’re living in one today: Healthcare costs in the U.S. currently make up more than 40% of global healthcare spending.1 It’s a growing problem – one that can’t be solved by doing what’s always been done.

Let’s take a deep dive into why and what we can do to fix it.

The Real Cost of Healthcare

America’s Prescription Drug Problem

Prescription drug costs are a major, but unsurprising, contributor to this problem.

On average, each American spends $1,443 on prescription drugs, compared to $749 per person in other countries.2 In Europe, drugs are priced by the government based on the benefit the drug will have for patients, but that’s not the case here.

For American manufacturers, the cost of making a drug is often much less than the price they charge patients – and the reason why is two-fold: to make a profit and cover the high cost of testing and releasing the drug.3

Critical Care at Sky-high Prices

Healthcare services play a big role in this nightmare, too.

For example, an MRI in the UK costs approximately $4502. In the U.S., the cost of healthcare services can vary wildly based on location. The average patient doesn’t know how much a service costs – that is, until they get the bill from their insurance company.

Public and private insurers in the U.S. have various out-of-pocket costs, funding sources, and rules, so it takes a variety of billing professionals to process claims. These billers must be trained and paid, and that’s reflected in premium prices.3

This leads to a bigger problem.

According to Harvard Magazine,4 nearly half of all Americans have delayed healthcare due to its high cost. Patients end up paying more in the long run, as their conditions advance and become harder to treat and cure. If preventive care were more affordable and accessible, patients could save their money and their lives.1

It’s a vicious cycle.

Americans underspend on primary care but overspend on prescription and hospital costs. Due to these two factors, employers’ costs rise year over year. So, what happens? Employers start reducing benefits and shifting costs to their employees, of course.

Combined with inflation, this is crushing middle America: Roughly 100 million Americans have racked up nearly $200 billion in medical debt. What’s more, this debt drives around half a million people to declare bankruptcy each year.5

No, this isn’t just a bad dream. It’s the reality too many Americans are living today.

The Risk of Traditional Plans

Traditional plans only multiply the problem.

Under a fully-insured healthcare plan, employers have little control over plan design. These off-the-shelf plans are inflexible and leave few options for employers to personalize their benefits to meet the specific needs of their employees.

The whole point of insurance is clear-cut in theory, but complex in reality: paying to shift risk from one party to another. But this risk largely falls onto the employer – partly due to the fact that health insurance isn’t really insurance.

In a fully-insured plan, you pre-pay for any claims that occur during a particular year. If you overpay at the beginning, then the carrier pockets the difference. If you underpay, you get a huge renewal. We refer to this as deferred, not insured: This plan involves you transferring all your costs (but no savings) forward by twelve months.

Traditional self-insured plans don’t fare much better.

Simply put, these plans are too risky for the smaller employer. Even if you’ve purchased stop-loss insurance to protect yourself, a large, multi-year claim can lead to a laser and/or huge premium increases.

The ParetoHealth Solution

ParetoHealth’s mission is to make self-insurance affordable, accessible, and less risky for small and mid-sized businesses. We also believe in patients getting the care they need when they need it – at the right price.

How ParetoHealth’s Program Works

When a small or mid-sized business chooses ParetoHealth’s employee benefits captive program, they join a community of like-minded employers committed to offering better employee benefits, reducing waste, and innovating healthcare on their own terms.

We refer to this as a coalition of the willing – a group of employers that grew tired of the status quo. They stopped doing the same thing and expecting different results. They grabbed the bull by the horns because changing healthcare for your organization means peeling back the onion and proactively managing claims.

Members own the captive.

The captive operates on a large scale with a large volume of stop-loss insurance, and so, can offer true multi-year protection from large and ongoing claims. Due to the program’s size and scale, it can offer superior terms such as rate caps and no new lasers, which are unavailable to most smaller employers purchasing stop-loss. For the first time, self-insurance becomes a viable option for these employers.

Members are in control of their plan, and they have the power to:

- • Choose their network

- • Select their plan design and TPA

- • Cut costs and improve coverage

- • Offer innovative healthcare programs, including:

- • Prescription drug cost control

- • Care coordination services

- • Oncology management

In this way, we can align the incentives of employees to get the best possible care with the incentives of the employers to provide cost-effective options.

The Industry’s Strongest Stop-loss Policy

ParetoHealth’s Members have access to the strongest stop-loss structure in the industry.

This means that they’re protected against large, ongoing claims and pay small claims as they happen without overspending or deferring costs.

But that’s not all: There is strength in numbers in the community, which creates a long-term buffer against stop-loss premium increases. Thousands of employers have access to their own data, they’re proactively engaged in cost-containment solutions, and they’re providing their employees with cost-effective, quality care.

Here, positive results aren’t difficult to come by.

Integrated Cost Management Platform

Managing healthcare costs is central to what we do.

ParetoHealth’s Integrated Cost Management (ICM) platform makes that happen.

Medical Cost Intelligence

ParetoHealth analyzes Members’ claims data to identify savings opportunities:

- • High-impact interventions: Our care-coordination partners look for signs of potential high-cost care needs such as cancer and neonatal events, then intervene to connect employees with providers who can deliver the best care at the lowest cost.

- • Data-driven playbooks: Our analytics partners and in-house experts work together to create playbooks with potential “plays” to cut costs. Members then work with their benefits consultants to implement these easy, personalized strategies.

Pharmacy Cost Intelligence

Pharmacy benefits can represent 20-25% of a program’s costs. With pharmacy prices on the rise, we continuously look for ways our Members can save – and they do: Members have potential annual savings of 25-30%.

- • Formulary management: ParetoHealth’s formularies support low, medium, and high drug cost-control approaches. Our experts actively look for savings opportunities.

- • Pharmacy benefits management advisory: Our experts negotiate pharmacy benefits manager (PBM) contracts and monitor their performance to ensure they comply with preferred pricing and rebate guarantees.

- • Specialty drug management: We can carve specialty drugs out of Members’ PBM contracts and use advanced analyses of clinical value, appropriate use, and other factors to reduce claims for very high-cost drugs.

- • Pharmacy playbooks: These personalized strategies reduce costs by replacing brand-name drugs with generics, finding low-cost therapies for high-cost medical conditions, and ensuring drugs are claimed through the pharmacy benefit – and more.

See What You Can Save

The nightmare price of American healthcare isn’t going to change anytime soon.

The good news is this: ParetoHealth can help you wake up, break out of the 12-month insurance cycle, and gain true control of your plan. Each day, we work hard to help small and mid-sized employers reduce the costs – not the quality – of their employee healthcare benefits.

Ready to get on the path to better benefits? Contact us to see what you can save.

References

1. World Health Organization. (2021). Global expenditure on health: Public spending on the rise? Retrieved from https://apps.who.int/iris/bitstream/handle/10665/350560/9789240041219-eng.pdf#page=11

2. Investopedia. (2022). 6 reasons why healthcare is so expensive in the U.S. Retrieved from https://www.investopedia.com/articles/personal-finance/080615/6-reasons-healthcare-so-expensive-us.asp

3. Porretta, A. (2022). Why is health insurance so expensive? eHealth. Retrieved from https://www.ehealthinsurance.com/resources/affordable-care-act/obamacare-premiums-unaffordable-for-many-middle-income-people-in-2019

4. Cutler, D. (2020). The world’s costliest health care and what America might do about it. Harvard Magazine. Retrieved from https://www.harvardmagazine.com/2020/05/feature-forum-costliest-health-care

5. Bedayn, J. (2023). States confront medical debt that’s bankrupting millions. Washington Post. Retrieved from https://www.washingtonpost.com/politics/2023/04/12/medical-debt-legislation/0198c70e-d995-11ed-aebd-3fd2ac4c460a_story.html

My role at ParetoHealth is to help employers and brokers find the most valuable benefits packages for their company and clients. Simple enough, right?

The reality is a bit more complex. A key function of my success hinges on educating people. However, before I can talk about ParetoHealth’s advantages, I need to establish my credibility. I understand that my affable disposition lends itself to your run-of-the-mill sales guy, but I assure you, I’m not out there to smash my quota and get a bonus. I can’t sell something I don’t truly believe in myself.

I believe there’s a better way to obtain the quality benefits that employees deserve, and it doesn’t have to come at a cost that shortchanges the future of mid-sized businesses.

That’s why I’m taking this opportunity to address one of the most common misconceptions: transitioning to a self-insured model is too difficult. Many think it’s an endeavor that rivals a Greek epic poem, with all parties at the mercy of an overcomplicated and tedious process.

TL;DR – it’s not.

Every employer’s situation is different, from scale to location. However, I’ve found what makes employers wary of self-funding generally comes from one of three myths:

Myth 1: It’s too complicated.

Reality: While our turnkey cost-management approach might be disruptive for the current state of the archaic insurance industry, making the transition from your current carrier to ParetoHealth is seamless. Most of our Members see no interruptions – major or minor – to their existing benefit structure. Employees can stick with almost every provider they know and trust without restrictions. The one big change: Members gain access to an enhanced benefits experience.

They enjoy the freedom of creating plans customized to their needs – or they can keep the exact plan designs they currently have in place. We make it easy because we understand that keeping employees happy is just as important as keeping them healthy.

But this is insurance – so surely implementation means a mountain of paperwork, red tape, and endless meetings?

Generally speaking, this part of the process is over in two or three brief meetings to sign some documents. It’s that easy.

Myth 2: It’s too risky

Reality: ParetoHealth’s mission is to remove the commonly associated risks of self-insurance to the benefit of small to medium-sized businesses.

Members of our captives are closely vetted to make sure only the right companies with the right leadership teams are joining. Then, after they join, our size and scale mean that we protect Members from unpredictable catastrophic claims better than anyone in the industry. This is how ParetoHeath mitigates the risk of self-funding.

Ironically, the real risk comes from remaining fully insured. Not only are you powerless to prevent big claims, but when one does happen (because it’s inevitable), your fully insured renewal will be through the roof! That terrible renewal will be your burden to bear – indefinitely. Because your current premium is the launching point for calculating your next renewal. In that way, the costs snowball, and you lose ground each year, and there’s no way to make up for it. It’s a financial catastrophe. So the sooner you switch to self-insurance, the better – which brings us to our next myth…

Myth 3: It’s not a good time

Reality: If you’re operating under a fully insured model, whether you had a good or bad year of claims, your annual premium will always increase. In a good year, your reward is a 2% increase…and that equates to a ton of profit for your carrier. On the other hand, if you’re running poorly and think, “I’ll wait until my claims clean up to move to self-funding,” I hate to be the bearer of bad news, but there’s simply no feasible way anyone can predict all the illnesses or prevent another catastrophic claim from happening.

What happens during month 13 if you stay fully-insured for another year? The scenario of the prior year repeats.

Once you step out from the blind alley that a fully-insured model kept you cornered in, you begin to see a bigger picture. You can build long-term strategies with predictable renewal rates and room to grow your business. NOW is always the best time to join ParetoHealth and get the protections and predictability that have alluded you for all these years.

Like all my colleagues at ParetoHealth, I take pride in my work and am here to help. I know the people behind the numbers. I see that HR director’s daughter who needs a monthly prescribed injection, I see the line worker’s wife battling cancer, and I will do whatever I can to ensure they have access to the best care possible. No matter how often I help unpack the same concerns for people, I still find purpose in it because, like the rest of my colleagues at ParetoHealth, I’m in this for the greater good.

My career in employee benefits and healthcare has spanned almost 40 years. In that time, I’ve been involved in helping go-to-market and sales teams bring solutions to a variety of organizations in the public and private sectors, from venture-backed startups to well-established, mature companies. My objective has been to improve the efficiency in the sales process by using data to drive growth, scale outcomes, and harness the potential of great ideas and solutions.

Regardless of the size, location, or industry of clients and prospective clients, they share a common financial burden. Employee benefits, and more specifically healthcare benefits for employees and their families, typically rank among organizations’ top five budget expenses.

In companies of all sizes, but particularly for small and medium sized businesses, I’ve seen business leaders who would otherwise have expanded their operations, raised salaries, or reinvested in their communities make the tradeoff of having to finance the ever-expanding burden of health insurance premiums. Even worse, in many circumstances, the staggering expenses didn’t lead to better health outcomes for their people who depend on these benefits.

ParetoHealth is on a mission to solve this dilemma for employers and employees alike, and I’m excited to be here. We are a company committed to bringing innovation to an industry long overdue for improvement. We are a company accomplishing audacious goals, while displaying some of the best aspects of the startup model: lean decision-making, a willingness to fight the status quo, and a focus on outcomes.

This company has been expertly built, with a foundational commitment to meeting the critical need for progressive ideas, values, and processes in the world of health insurance. At ParetoHealth, this commitment and our resilience starts with:

-

- Our People

As a team, we’re a single force united by our commitment to challenging an industry that needs to do better – by the employers burdened with the untenable cost of health benefits, to employees who rely on those benefits for access to affordable healthcare. Collectively we settle for nothing less than greatness. We measure our success by the good that comes from knowing that every Member and all their employees can count on effective, affordable healthcare for years to come. As individuals, that inner drive extends beyond our work at ParetoHealth and contributes to the greater good within the communities we live in and the varied cultures we represent.

- Our People

-

-

- Our Solution

ParetoHeath’s turnkey cost-management approach to employee benefits is truly disrupting the current state of the industry. We give our Members access to services previously only available to the largest companies in the country. This lets them respond to the needs of their employees, and we make it easy – all backed by the strongest stop-loss policy in the market.

- Our Solution

-

- Our Members

The Members we serve are a special group – true contrarians. Helping them make a big impact to their bottom line while safeguarding employee health provides us with incredible inspiration. This inspiration runs deep as we now cover more than 2,200 employers representing over 810,000 covered lives.

- Our Members

-

- Our Consultant Partners

Last Fall I had the privilege of attending ParetoHealth’s Prospective Members Meeting. In addition to prospective Members, I met many of their brokers and consultants. We are very proud of the advisors who partner with Pareto: professionals looking for innovation to address the endless cycle of fully insured premium increases. These consultant partners see the value of leveraging the solution and community that makes us Pareto.

- Our Consultant Partners

-

- Our Technology

Alongside integrating with carriers to produce quotes faster, more efficiently, and with less margin for error, ParetoHealth has developed an Integrated Cost Management (ICM) platform. The platform analyzes each employer’s unique data and proposes customized strategies (“plays”) that are likely to offer savings opportunities. Just as importantly, employers save precious time and money by forgoing initiatives that aren’t likely to result in much benefit because we rely on facts, not guesswork.

- Our Technology

-

- Our Opportunity

When it comes to scale, ParetoHealth’s mark in this industry is formidable. With almost $3 billion in healthcare spending under management, our competitors cannot offer the stability and scale that our captives already include. Only 27% of all mid-size American companies are currently self-insured. Our opportunities to expand, to serve the remaining 73% of them, are truly incredible.

- Our Opportunity

Amid what is undoubtedly an exciting time at ParetoHeath, I have a lot to look forward to, as well as a lot to contribute. I look forward to continuing to build on the deep relationships the team has cultivated and to recruiting highly motivated new talent to help us crush the opportunity we see to serve small and medium sized business and their consultants.

-

-

We have four foundational principles at ParetoHealth. One is fire in the belly. I’m committed to honoring and maintaining the company’s tenacious spirit. A quality that, in the short time that I have been serving as Chief Sales Officer, has stoked that fire.

As we approach the new year, now is the right time to review the healthcare trends likely to impact your employee benefits. This can be daunting, so we’ve gathered the data for you.

Let’s dive right in.

The 2023 Global Medical Trends Survey reports that the cost of healthcare on a global level will increase at the highest rate in 15 years1. In North America, the Segal Group predicts that health insurance premiums will increase by 7% or 8% rather than the usual pace of 6% per year2. The survey cites inflation and increased healthcare utilization as the driving forces.

As we emerge from the COVID-19 pandemic, insurers are concerned about consumers’ shifting relationships with healthcare. Many postponed care during the height of the pandemic, so utilization is higher than usual, as patients return to the doctor for more than just an annual checkup and face the consequences of delayed care.

Seventy-five percent of insurers polled said they are concerned about providers overreacting and recommending too many services. But that’s not all. Fifty-two percent worry about their members’ health habits, and 50% cited the underuse of preventive services as a cause of rising costs.1

A 10% increase in overall prescription drug costs is another troublesome circumstance facing employers, mainly driven by medical innovation. Expensive drugs like gene therapies and new HIV treatments emerged on the market this year (which our CEO Andrew Cavenagh predicted in his first blog post). These drugs provide life-altering benefits to those who receive them, but the release of generics, which would help to control market costs, has not kept pace2.

The Inflation Reduction Act will allow Medicare to negotiate the prices of ten common drugs, which will bring some relief to consumers. Still, this changes the economics of certain drug products, and insurers will look to any savings as opportunities to build in profit. In turn, you can expect pharmaceutical companies to hike prices for private insurance companies2.

Employers will have to balance increasing costs with salary demands—all in the midst of a possible recession. In addition, the labor market remains fairly tight, and rising healthcare costs may eat into the funds needed to offer competitive salaries.

Coverage gaps may impact employers’ Diversity, Equity, and Inclusion (DEI) initiatives, as certain gaps, such as fertility treatments, midwives, and HIV/AIDs treatments, tend to be more statistically prevalent among specific segments of the population. However, as noted in the survey report, “Employers have an opportunity to work with their consultants and brokers to bridge these coverage gaps and help deliver more equitable health outcomes across different employee groups.”2 Bridging coverage gaps always has an associated financial cost. Still, employers may have difficulties hiring and retaining employees when they ignore these gaps.

It is not all bad news. The No Surprises Act was enacted this year, and early indications are it effectively reduces unexpected out-of-network hospital charges2. Telehealth is also becoming increasingly valuable; it was ranked as the second-best cost management tool, gaining traction from last year1.

Other key findings are that cancer is the number one condition affecting medical costs, followed by musculoskeletal and cardiovascular disorders. Mental and behavioral health disorders are ranked the fourth most common by incidence and claims and are expected to keep climbing1.

So, what should employers do with this information?

If you’re worried that members are underutilizing their primary care and preventive services, find ways to incentivize the use of those benefits. Since mental and behavioral health claims are on the rise, make sure your benefits provide these resources at the best value to your employees. If there are gaps in your coverage, especially if they relate to DEI initiatives, address them to prevent future hiring issues and legal troubles. Overall, think about how to personalize your benefits to meet the specific needs of your employees.

Stop “just” buying insurance and start delivering great healthcare benefits and resources to your employees.

To mitigate increasing prices, employers should prioritize cost-containment solutions. Fortunately for you, cost containment has been our focus since ParetoHealth’s inception. We believe it’s crucial to know where your healthcare dollars are going and analyze trends to ensure that you are spending wisely while not compromising access or quality of care.

If you’re fully insured, and don’t have visibility into your claims data, now is the time to change that. Being self-insured and part of our captive allows you to make customized, long-term strategies to help weather the blows of inflation and medical trends.

Start the new year right. Learn more about making the essential switch here.

References

1. WTW. (2022). 2023 Global Medical Trends Survey. Retrieved from https://www.wtwco.com/en-MY/Insights/2022/10/2023-global-medical-trends-survey-report

2. Payne, D. (2022). What will happen with health costs in 2023? Kiplinger. Retrieved from https://www.kiplinger.com/personal-finance/inflation/605084/what-will-happen-with-health-costs-in-2023

No matter where you are in the world, you probably know someone with diabetes. In fact, research suggests that in the United States alone, diabetes affects an estimated 114.4 million Americans, including those that are diagnosed, prediabetics, and undiagnosed diabetics.1 These numbers are expected to grow, with at least 15-30% of pre-diabetics developing type 2 diabetes within 5 years.8 If current trends continue, 1 in 3 Americans will develop diabetes in their lifetimes.2

The consequences continue well after the disease develops. Over a third of people with diabetes develop issues with their blood pressure and cholesterol.3 When left unmanaged, these patients can undergo more serious conditions like heart disease, stroke, kidney failure, lower limb amputations, and adult-onset blindness.4

The costs attached to the disease are also alarming. In 2017, the estimated cost of diabetes in the United States was $327 billion, including $237 billion for direct medical costs and $90 billion in indirect costs for disability, time off from work, and premature death.5 The contribution to overall healthcare costs is so significant that if health center patients with uncontrolled diabetes could reduce their HbA1c (glycated hemoglobin linked to sugar) by just 1.25%, the potential savings in medical costs could exceed $3.44 billion over three years.6

The truth is, diabetes can severely impact a person’s quality of life, and in some cases, cut It short altogether. With alarming numbers to back this up, you could consider diabetes as an expensive, worldwide epidemic.

Which means that the time to act is now.

Fortunately, there is a lot you can do to target this problem directly and indirectly. Raising awareness, providing actionable steps, and actively supporting employees in the workplace is an excellent place to start.

Here’s a list of various tools that your organization can implement to combat type 2 diabetes at work7. As you safeguard health, you also ease what is likely a significant burden on your overall healthcare spending and have a chance to dramatically improve quality of life.

1. Conducting internal health surveys

To form a baseline for your population of employees, use employee health surveys to identify the percentage of workers touched by the diagnosis or at risk of a diagnosis. The results of this survey can help you recognize those that have received appropriate screening for type 2 diabetes and educate individuals that may need direction towards counselling or follow up screenings like blood glucose testing.

If you include lifestyle concerns like physical activity, nutrition, and obesity as part of your survey, this will give you a holistic perspective of your employees’ health.

Overall, creating this baseline should aid in designing the necessary programs for your employees.

2. Developing employee wellness programs

Wellness programs in the workplace targeting lifestyle improvements like good nutrition, weight management, and increased physical activity can directly address type 2 diabetes by delaying the onset of the disease.

According to clinical trials from 2001 by the National Diabetes Prevention Program, “Modest weight loss and physical activity substantially reduced progression to type 2 diabetes among adults who were at very high risk.” Additionally, improved nutrition plays a significant role in helping people cut their risks. In fact, the American Diabetes Association recommends that even people with prediabetes should be counseled on the same lifestyle changes.

So, engaging your employees in these activities could substantially affect the outcomes of the disease.

3. Education

To truly target the disease, education is crucial. Consider self-management education, disease management awareness, or training–a principal step in improving diabetes care and quality of life.

By hosting educational opportunities for your employees on certain behaviors like healthy eating, movement, and monitoring blood sugar, you encourage a collaborative process in which educators help workers with diabetes or at risk for it gain the knowledge, problem-solving, and coping skills needed to deal with the disease and its related conditions.

4. Access to care and disease management

Whether by providing on site flu shots (diabetics have higher susceptibility to influenza), or making sure each individual is connected to the right team of experts, you should consider having a unique plan of action for diabetes-specific care.

For example, you can utilize a coordinated care team that educates and helps prevent complications and development of co-occurring conditions that may arise with the diagnosis.

In general, guidance, direction, and encouragement from the workplace has a significant impact on handling the disease.

More than likely, diabetes is already playing a significant role in your employees’ overall health. For just that reason alone, it is worth considering taking the extra mile to prevent and manage it. Not only does that improve your employees’ health, but it can also support significant savings.

Lifestyle diseases tend to have a duality to them—when left unchecked they lead to a plethora of other problems, but when prevented or managed correctly and aggressively, this is key to a happier and healthier world, both in and out of the workplace.

Sources:

1. CDC. National Diabetes Statistics Report, 2017 – Estimates of Diabetes and Its Burden in the United States. 2017. https://www.cdc.gov/diabetes/pdfs/data/ statistics/national-diabetes-statistics-report.pdf.

2. Boyle JP, Thompson TJ, Gregg EW, et al. Projection of the year 2050 burden of diabetes in the US adult population: dynamic modeling of incidence, mortality, and prediabetes prevalence. Popul Health Metr. 2010;8:29.

3. American Diabetes Association. Standards of Medical Care in Diabetes—2019 Abridged for Primary Care Providers. Clin Diabetes. 2019;37(1):11-34. doi:10.2337/cd18- 0105

4. 3. ODPHP. Diabetes | Healthy People 2020. Healthy People 2020. https://www.healthypeople.gov/2020/topics-objectives/topic/diabetes. Accessed October 4, 2019.

5. American Diabetes Association. Economic Costs of Diabetes in the U.S. in 2017. Diabetes Care. 2018;42(10):dci180007. doi:10.2337/dci18-0007

6. Fitch A, Everling L, Fox C, et al. Health Care Guidelines – Prevention and Management of Obesity for Adults. Inst Clin Syst Improv. 2013;Sixth Edition. https://www. healthpartners.com/ucm/groups/public/@hp/@public/documents/documents/cntrb_037112.pdf. Accessed October 8, 2019.

7. https://www.cdc.gov/workplacehealthpromotion/health-strategies/diabetes/interventions/programs.html

8. CDC. National Diabetes Prevention Program: Working Together to Prevent Type 2 Diabetes. The Diabetes Prevention Program. https://www.cdc.gov/diabetes/ prevention/pdf/NDPP_Infographic.pdf.

If you’re an employer and you don’t know what ‘leveraged trend’ is, you need to learn. It will impact the pricing of every type of health insurance, whether fully-insured, level funded, or self-insured in the coming years.

Leveraged trend, in simple terms, is the tendency for large claims to increase at a higher and faster rate than small claims. How this happens is slightly more complicated. Let’s get into it using an example.

First, though, some underwriting math. Exciting, I know but, as always, the devil is in the details.

An Example

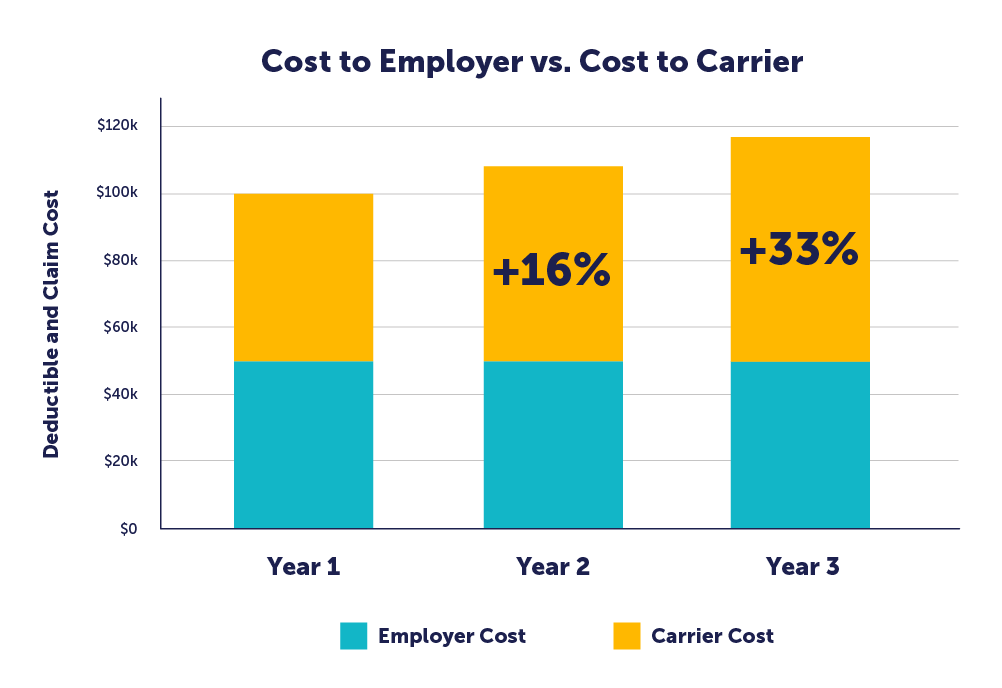

Imagine you’re a self-funded employer with a $50,000 specific stop-loss deductible. In year 1, you have a claim for $100,000. On a $100,000 claim, you will pay $50,000 and the stop-loss carrier will pay $50,000. What happens if the same claim occurs again the following year (year two)?

Well, if medical trend continues, the cost of the year 2 claim will be higher (this is, after all, what the term “medical trend” refers to). Assuming that medical trend is 8%, the cost of the claim in year two will be $108,000. If your deductible has stayed the same, you will still pay the first $50,000, but the stop-loss carrier will pay $58,000.

In this way, a medical trend of 8% represents an increase of 16% for the carrier. When we look at third-year costs, the difference becomes even starker. A further 8% increase on $108,000 puts the total price at $116,640, or a 33.3% increase to the carrier as compared to year 1.

So, while the employer’s cost for the claim remained flat, the carrier’s cost has increased more by than 33% over two years. Carriers will naturally pass these increased costs along to the employer through increased premiums.

This example was for a self-insured employer using stop-loss, but the same phenomenon will impact fully-insured or level-funded employers in the form of increased pooling charges. The principle is the same: rising claims impact the carrier at a higher rate than they do the insured, and the carrier will seek to offset those costs.

Accelerating factors

Leveraged trend is a mathematical phenomenon that always exists, but several other things amplify overall costs, particularly the cost of large claims.

The two major factors that will further accelerate the underlying medical trend are inflation and high-cost claims.

The first is inflation. Our current economic situation is unusual in that we have a combination of high inflation, negative growth in the overall economy, and a highly competitive labor market. Approximately half of a hospital’s overall expenses are related to labor, according to the American Hospital Association. As competition increases for talent in nursing, medicine, and hospital administration, the cost of attracting and retaining medical employees is sure to increase. Wage inflation drives medical inflation, which is amplified by leveraged trend.

The second driver of medical trend is the increasing frequency of high-cost, multi-year claims. As we covered in our very first article in The Contrarian, we are likely to see new gene therapies approved for conditions ranging from refractory follicular lymphoma, hemophilia A and B, and diabetic peripheral neuropathy. These are medically exciting treatments for devastating conditions, but they come with staggering financial costs. This will disproportionately increase the cost of large claims.

As we often say, it is no longer a question of whether you are likely to face a million-dollar claim, it is a question of when. Between interventions for cancer, new gene therapies, hemophilia, or end-stage renal disease (“ESRD”), employers can no longer afford to ignore the prevalence of this type of claim.

What to Do

The first priority for an employer us to take air out of the proverbial balloon by trying to reduce medical costs. The smaller the denominator, the smaller the impact of inflation and leveraged trend. You probably cannot do that if you’re fully-insured or level-funded, as you cannot pull the appropriate levers.

After that, an employer should protect themselves from the volatility of these large/increasing claims. If you are fully-insured or level funded, you’ll feel the impact of greater medical inflation and leveraged trend and a further multiplier in the form of administrative expenses and profit loads.

If you are self-insured, a bare-bones stop-loss policy does not adequately protect employers from the impact of high-cost claims. A ParetoHealth captive provides far more insurance and protection against these large and ongoing claims. The first part of this protection is our 30% cap on stop-loss premium increases. 30% seems like a lot but considering that this premium is such a low percentage of your overall costs, it only leads, on average, to a 7.5% increase in spending. That’s your worst-case scenario, and it doesn’t happen often.

The second is our “No New Lasers” guarantee. Many stop-loss policies include a provision like this, however, they only last the next 12 months. Ours stays in effect for the entire lifetime of your Membership. In all the time we’ve been in business, we have issued exactly zero new lasers.

As always, we need to emphasize one fact: fully-insured employers face a significantly worse situation when medical trend increases than do self-insured employers. Stop-loss premium is a much lower percentage of overall spending for the former than fully-insured premium is for the latter. Additionally, self-insured employers can control the types of benefits they offer, eliminating unnecessary and unused benefits and identifying strategies and implementing high-value programs that address the unique needs of their employees. Fully-insured plans also place more of your healthcare spending in the purview of the carrier, meaning that they have more opportunities to extract profit from various levels of transaction. The cherry on top comes from higher taxes for fully-insured programs.

This begs the question: how do you reconcile the inadequacy of bare-bones stop-loss with the manifest unworkability of the fully-insured model?

The solution is to add a layer of protection, that insulates the employer and, to a certain extent, the carrier. The only way to ensure that the model continues to work is to reduce the volatility of pricing, to flatten the spikes in overall costs.

ParetoHealth offers that solution, and if you are interested in learning more about how we get this done, I invite you to read our analysis of how a group benefits captive controls volatility here: https://paretohealth.com/blog/5-ways-paretohealths-captives-manage-volatility/

We are quickly approaching everyone’s least favorite time of the year – open enrollment.

If you’re fully insured, you’re on pins and needles, waiting to know if you’re going to get a good renewal or a bad renewal. You cannot do much to prepare for open enrollment, because until you get your renewal, you don’t know what your rates will be or who your carrier will be (since you might change carriers based on renewal and competing prices).

If you’re self-insured, you’re in a much better spot. You are still waiting on a stop loss renewal quote, but that quote is unlikely to prompt a change in TPAs or networks – so you can finalize plan design and schedule open enrollment with confidence.

Many employers and their brokers think that they need to wait to see their stop loss quote before setting accrual rates and scheduling open enrollment – but this couldn’t be further from the truth, at least if you’re in one of ParetoHealth’s captive programs. Let me explain why.

Assume a hypothetical ParetoHealth Member (“XYZ Manufacturing”) with 200 employees has an expiring stop loss premium of $400,000 at a $50,000 specific deductible, and an aggregate attachment point of $1.6m. With their consultant’s help, they should be able to estimate the renewal with enough certainty to determine accrual rates and hold open enrollment – and they can worry about the stop loss renewal later.

In this blog post, I will be going over the process you can use to make this estimation, as well as examining the various factors that go toward making it up. First, I’ll go over aggregate claims, then move onto specific premium, then look at expenses. Add these together, and we can get a good estimate of our total.

If you’ve already gotten your quote, or if you already know how to calculate it, then check out these tips on making open enrollment a success.

Aggregate Claims

To calculate accrual rates, start with the biggest component, the aggregate claims. The industry would have you believe that calculating aggregate claims is as complicated as going to the moon, but that’s just not true. It is very easy to produce an estimate that is directionally correct. At the core of most calculations, you take the monthly aggregate claims (meaning you cap all claims at the level of the specific deductible) over the last 24 months. Next, convert to a PEPM to eliminate fluctuations in enrollment, average them, and then add a factor for medical inflation from the midpoint of the data. You then apply this figure to your anticipated enrollment. I’d suggest assuming an overall medical trend of about 6-8% (this number might go higher in future years given all the pressure on medical wages).

Let’s use some numbers to make this a bit more concrete. These are purely hypothetical, but I’ll assume that the 24-month average claims on a PEPM basis were $490. If we take the $490 and multiply it by 1.08, we get a $530 PEPM rate for expected aggregate claims. We multiple that by 200 employees and by 12 and get an annual estimate of $1.270m. This is the first part of our renewal estimate.

Remember that the stop loss carrier’s aggregate factors don’t determine your claims – your population and their health conditions determine your claims – so don’t fall into the trap of assuming that 80% of their renewal aggregate factors is some magic number. If you want to listen to us make fun of people who do that, listen to our podcast.

Specific Premium

Our hypothetical expiring premium is $400,000 for a $50,000 specific stop loss. Stop loss premiums increase faster than the underlying medical inflation rate due to leveraged trend (you could cite the other podcast here but that might be too much). The industry average for levered trend for a $50,000 specific stop loss is probably 15-17% – but we’ll use 15% to make for easier math. Our employer can therefore assume a 15% increase and calculate a renewal stop loss premium of $460,000. This is the second part of our renewal estimate.

Expenses

If you’re self-insured, you’re paying a TPA (and maybe your consultant) on a PEPM basis. Let’s assume this is $50 PEPM, or a total $120,000. You can probably assume TPA expenses will increase about 3% a year, giving a renewal cost of $124,000. This is the third and final part of our renewal estimate.

Total

We now add all three parts together – aggregate claims (not aggregate factors), specific premium, and expenses – and get a total $1.854m. This can be used to set accrual rates and you can hold open enrollment without waiting for your stop loss renewal.

When I explain this to people, the first reaction I typically get is, “But what happens if the specific increase is a lot higher than 15%”? The answer is “not much.” If the stop loss increase had been 25% instead of 15%, the premium would have been $40,000 higher. The overall cost only increases by 2.2% – not enough to worry about (and the same thing is obviously true with a lower increase). The one caveat I’d put here is that I’m assuming you’re in one of our captives, meaning that your maximum stop loss increase is 30%. If you aren’t in one of our captives, it’s possible you could have a massive increase in your stop loss premium – either directly or using lasers – but that just highlights why you want to be in our captives.

The bulk of the estimate is in the aggregate claims, so that is where the variance is likely to come from, not the specific premium. If you have anything unexpected going on with your aggregate claims, ask for help – from your broker, an actuary, or someone at Pareto.

But remember that no matter where you set your estimate losses, aggregate factors, and accrual rates, they are all just estimates. They will be tested over the next 12-18 months, and it is very unlikely you’ll be spot on – some years you’ll overshoot and some years you’ll undershoot – but the amounts are small and easily adjusted in your financial statements.

So yes, open enrollment sucks – but if you’re in one of our captives, it doesn’t have to be a last second mad dash. It can be scheduled months in advance, and you can spend your time worrying about what is driving costs and what do to about it – not the small variability in a stop loss renewal.

Once you calculate your self-insured costs to plan for open enrollment – or get your renewal quote – then the time has come to communicate what you’ve found out about your benefits package to employees.

Whether you’re a seasoned pro who has managed open enrollment many times before or a relative newcomer to this particular task, there are certain things you can do to make it a success.

Open enrollment is a perfect chance to engage your employees about their health benefits. It gives them an opportunity to understand their benefits plan better and ensure they use them effectively. It also helps them get a look behind the scenes at the costs, administrative work, and future perspective of these plans, allowing them to plan for the future with more confidence. All of this is an excellent way of retaining high-quality talent.

1. Provide in-person sit-down enrollment sessions or open office hours for them to ask questions. If you deliver the information with a personal touch, they will receive and retain it better. Plus, you will be better positioned to answer questions and allay any concerns that they might have about the specifics of their programs.

2. Make sure employees understand payroll contribution frequency, when contributions start, and anything else that may impact their paycheck. This eliminates unpleasant surprises when plans kick in.

3. Related to the previous point, give employees a tool to calculate exactly how much their benefits package will cost before they make the choice. It can be as simple as an Excel table to show them a variety of different costs: the annual election cost, the cost of copays or deductible, and their personal out-of-pocket maximum. This helps them decide based on the specifics of the situation, not just one factor taken in isolation.

4. If there are any significant changes to your benefits package, present them to the entire company in-person or on video. Personal messaging fosters an environment that shows you care about your employees, rather than making changes without public explanation or warning. Whenever possible, include an interactive portion to this presentation to let your employees ask questions, as well. Transparency is always the best policy.

5. Provide the appropriate time for employees to consider their options before making a final decision. However, it’s important to get the timing of this issue right – give them enough time, but not too much. In my experience, give them two weeks to think about it, but no more. If you wait too long, people might forget, but if you don’t afford them enough time, adoption rates may suffer because people don’t have enough time to ask questions or properly evaluate selections.

6. Invite eligible family members to attend open enrollment meetings along with the employees. Spouses may offer important ideas and contributions that aid in the decision-making process, and they also deserve a comprehensive understanding of the package of services. If they will be using them (and many do), then they have a right to get a fuller picture of what is going on.

7. Be as open as possible about how much the company spends on benefits. Transparency helps employees appreciate the actual costs involved and gives them a fuller picture of their entire compensation package. People feel more valued if they know that their total compensation is greater than just their salary, it includes additional costs as well. Letting people know how much you value their contributions is a great way of retaining them.

8. Require employees to actively opt out of benefits. This helps ensure that they have viewed their options. Encouraging conscious decision-making is always better if you want them to make their decisions thoughtfully and weigh all of their options.

9. Provide paper copies of your enrollment materials. Not everyone likes digital versions and giving people information in a variety of formats makes it easier for everyone. A variety of media considers various learning styles and helps your employees retain the information better.

10. Make sure employees know when they will get ID cards (or how to access them digitally) and when benefits become effective. Clarity on these points prevents costly misunderstandings, and it also helps people plan appropriately. Additionally, people appreciate knowing that you have planned out their benefits program wisely and in advance. Getting early notice of when they are going to get ID cards is just one way of making this happen.

11. Ensure employees always know where they can access summaries of benefits and coverage, as well as what resources are provided along with the benefits (telemedicine, health guides, etc.) so that they can always easily review benefit features. Make sure these are as clear as possible since many people do not think about their benefits until they have a health problem. When they are in a stressful situation such as this, it is more difficult to recall information.

12. Give employees a designated time during the day to review their options rather than requiring them to do it outside of work hours. Nobody likes homework, after all.

With these tips, you’ll be sure to have a successful open enrollment season this year. Clear, effective communication is the lifeblood of any organization, and your business is no different. We have to do everything we can to make sure that people can make the best decisions for themselves if we want a well-functioning, contented group of people working with us.

One of the most significant hurdles faced by self-insured employers – especially those new to self-funding – is how to interpret the information and feedback you receive now that they have access to plan data. Even “blinded” data offers a tremendous opportunity to reveal claims trends and identify actionable strategies.

For those of us who have been immersed in the sphere for more years than we care to admit, gleaning insight and shaping strategies can seem obvious. But the things that are intuitive and obvious to us are often the result of our experience, and if you don’t have that same degree of experience, these things can be opaque, confusing, or seem contrary to common sense.

As stewards of self-insured benefits plans, how can we bridge this knowledge gap? How can we lend our expertise to improve the experience of employers using our funding methods? And how can we carry the burden of maintaining these strategies, so employers don’t have to?

One of the ways that we get this done involves our use of data, our flexible cost-containment measures, and good old-fashioned industry expertise to guide the owners of our captives – the Members.

We deliver this guidance through ParetoHealth Playbooks.

To explain what these do and their role in our benefits strategies, we have to go right back to the beginning.

We started ParetoHealth in 2011 and cost containment was central to our mission from day one. The approach was simple. Members implemented health risk assessments, conducted biometric screenings, and encouraged tobacco cessation. These basic strategies helped employers support the health and well-being of their employees.

These remain good foundational measures, but things have evolved dramatically. Today, a variety of strategically significant cost-saving measures are united under a single umbrella, ParetoHealth’s Integrated Cost Management (“ICM”) program. The ICM program is an optional solution for ParetoHealth Members, who are also welcome to opt out if they decide it’s not right for their group.

Launched in January of 2020, ICM analyzes employer-specific data and produces a customized, actionable plan for that group based on their unique data. Too often, “strategies” are based on the data of an entire industry or captive. Landing on an effective strategy is much like swinging away at a pinata while blindfolded – sure, there’s a chance you hit it, but there’s a better chance that you miss the mark completely. ICM is based on more than hope and luck – the strategies succeed because they respond to the specific needs of the group. Through a careful analysis of the data, we identify the most effective cost-management options for that group and eliminate programs that aren’t likely to offer much impact.

When it comes to programs, ICM expands the measures of earlier days to include a variety of fully integrated services, emergency interventions, and retrospective data analysis that helps our Members chart a course into the future. These things work in tandem to deliver a long-term solution to control costs while safeguarding the well-being of the people who work for them.

So, in other words, these playbooks are deep analyses of existing health plan data, which we deliver to everyone on our ICM platform. We eliminate the guesswork and maximize the ROI. After identifying the right strategies, we provide straightforward – often turnkey – advice on how to implement these strategies and optimize them for the future. We continually reanalyze the data and propose adjustments based on the latest data and trends.

Gone are the days when employers could only reduce healthcare spending by cutting their benefits. By implementing a data-driven, actionable plan, ICM allows ParetoHealth Members to embrace a true cost-management strategy that will serve them well into the future.

Employers must have a sound strategy to combat rising costs

You’ve heard the grim statistic – Americans pay more for healthcare than any other nation but receive less treatment and poorer outcomes. Spending on drugs and medication makes up a large portion of these costs. According to The Peter G. Peterson Foundation, U.S. healthcare spending averages $12,500 per person. By comparison, countries such as Canada, Austria, and France only pay about one-third as much1.

The Congressional Budget Office has calculated that the share of US healthcare spending on prescription drugs has risen from 5% of the total in 1980 to almost 10% in 2018. Both the number of prescriptions written and their overall costs have increased.

But why do drugs cost so much? Among the reasons:

1. The cost of drug research and development (R&D) is massive

This factor is the primary driver of the high cost of drugs. The process of turning raw materials – whether natural or synthetic – into drugs safe for consumption is extremely costly. The National Academy of Sciences revealed that it costs anywhere between hundreds of millions of dollars to $2 billion to bring a drug to the market2. Also, consider that nearly 9 out of every 10 drugs developed never make it past clinical trials3. The price of a prescription drug includes all the research and development costs of failed drugs, plus the cost to manufacture your prescription drug, plus a layer of profit for the drug company. Add all of these things together and you face a whopping price tag.

2. A lack of market competition and drug-specific monopolies

In the prescription drug industry, a single company often has a monopoly on the rights to a drug. Thanks to patent exclusivity, they get to produce, distribute, and sell it without any competition.

Also, since drugs are necessities and not luxury goods (despite some drugs being priced as high as luxury goods), drugmakers can set prices that they know people – and insurers – will have no choice but to pay.

3. “Pay for delay” agreements

Generic alternatives help to decrease the costs of drugs. When the patent exclusivity of a drug expires, other companies can develop generic drugs – ones that function the same but aren’t branded.

To stall this, pharmaceutical companies who own the patents to the drug may engage their competitors in “pay for delay” agreements, whereby they pay their competitors to delay producing and launching generic versions.

As a result, a single drug company may continue to hold a significant market share of a drug well after expiration of patent exclusivity.

4. Patent evergreening

Going back to patent exclusivity, drugmakers sometimes engage in “evergreening” to extend their exclusive rights to a drug. There are a few ways they can do this, such as repurposing or altering the drug.

For example, if the medication was formerly distributed in pill form, pharmaceutical companies may revamp the drug by turning it into a powder. They rename the drug and apply for new patents, giving them extended rights to expiring patents.

5. Lobbying from Big Pharma

The power of pharmaceutical companies is massive, with the lobbying group for the pharmaceutical industry spending about $27.5 million on lobbying activities in 2018 alone4. They’ve managed to achieve this through a vicious cycle of leveraging money to secure power to continuously grow financially. It’s a loop that leads to more profits for drugmakers and the intermediaries involved.

As prescription drug costs rise at a rate of 2 to 3 times that of inflation, Congress has responded with bills to curtail costs2. But given the mammoth lobbying machine of big pharma, the likelihood of successful legislative reform is dubious, at best.

6. Drugs don’t have price regulations

The U.S. Food and Drug Administration (FDA) regulates how new drugs are tested, marketed, and released on the market. What they don’t regulate (and control) are prescription drug prices and enforceable mechanisms for value-based pricing5. That role goes to drug companies who very clearly have an interest to price drugs as high as possible.

7. There is no price ceiling on drugs

According to a report by Healthline, the U.S. government does not set ceiling prices like in other countries6. Because of this, the price for an annual supply of certain drugs can cost as much as a single-family home.

8. The cost of marketing and advertising drugs

Did you know that in many pharmaceutical companies, the cost of marketing and advertising can go as high as – if not even higher than – a drug’s R&D costs8? Marketing and advertising drugs is a hot business, especially between drug companies and healthcare professionals, to influence the medical choices of patients.

9. A lack of transparency in the chain, with intermediaries that complicate the whole process

Intermediaries such as insurance companies and Pharmacy Benefit Managers (PBMs) play a key role in getting drugs from the makers to the payers – but they can also contribute to the expense of drugs. It’s a complicated multi-player system where many entities are each taking a margin, and the employers and individuals who pay for healthcare plans suffer the brunt of the cost.

The maddening reality for employer-sponsored health plans (and consumers) is these particular factors are largely beyond their control, and absent widespread reform within the industry, costs will continue to climb. However, there are strategies and resources for employers that very effectively help employers to manage the costs. Contact ParetoHealth to learn more.

References

- 1 Peter G Peterson Foundation (2022) Why Are Americans Paying More For Healthcare?. Retrieved July 8, 2022, from https://www.pgpf.org/blog/2022/02/why-are-americans-paying-more-for-healthcare

- 2 National Academy of Sciences (2022) Why Do Drugs Cost So Much? Retrieved 8 July, 2022, from https://thesciencebehindit.org/why-do-drugs-cost-so-much/

- 3 Congressional Budget Office (2021) Research And Development In The Pharmaceutical Industry. Retrieved 8 July, 2022, from https://www.cbo.gov/publication/57126

- 4 Scutti, S. (2019) Big Pharma spends record millions on lobbying amid pressure to lower drug prices. CNN. Retrieved 7 July, 2022, from https://edition.cnn.com/2019/01/23/health/phrma-lobbying-costs-bn/index.html

- 5 Rajkumar S.V. (2020) The high cost of prescription drugs: causes and solutions. Blood Cancer Journal. Retrieved 8 July, 2022, from https://www.nature.com/articles/s41408-020-0338-x

- 6 Curley, C. (2021) Prescription Drug Prices in the U.S. Are Twice as High: Here’s Why. Healthline. Retrieved 8 July, 2022, from https://www.healthline.com/health-news/prescription-drug-prices-in-the-u-s-are-twice-as-high-heres-why

- 7 NPR, Kodjak A. (2019) Prescription Drug Costs Driven by Manufacturer Price Hikes, Not Innovation. NPR. Retrieved 7 July, 2022, from https://www.npr.org/sections/health-shots/2019/01/07/682986630/prescription-drug-costs-driven-by-manufacturer-price-hikes-not-innovation

- 8 Emanuel, E.J. (2019) Big Pharma’s Go-To Defense of Soaring Drug Prices Doesn’t Add Up. The Atlantic. Retrieved 7 July, 2022, from https://www.theatlantic.com/health/archive/2019/03/drug-prices-high-cost-research-and-development/585253/