If you’re an employer and you don’t know what ‘leveraged trend’ is, you need to learn. It will impact the pricing of every type of health insurance, whether fully-insured, level funded, or self-insured in the coming years.

Leveraged trend, in simple terms, is the tendency for large claims to increase at a higher and faster rate than small claims. How this happens is slightly more complicated. Let’s get into it using an example.

First, though, some underwriting math. Exciting, I know but, as always, the devil is in the details.

An Example

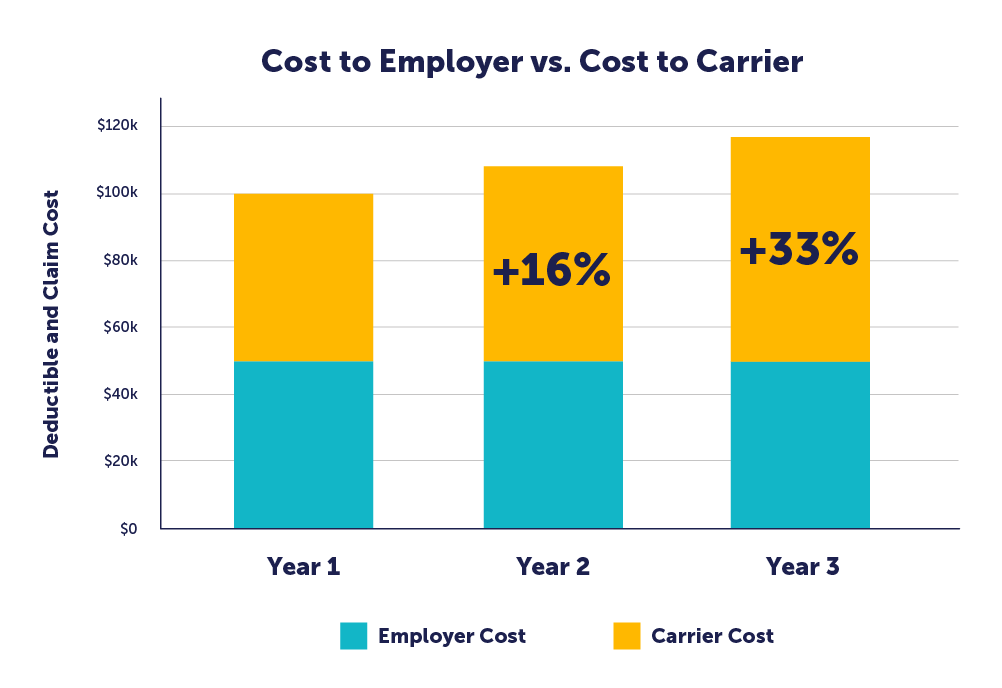

Imagine you’re a self-funded employer with a $50,000 specific stop-loss deductible. In year 1, you have a claim for $100,000. On a $100,000 claim, you will pay $50,000 and the stop-loss carrier will pay $50,000. What happens if the same claim occurs again the following year (year two)?

Well, if medical trend continues, the cost of the year 2 claim will be higher (this is, after all, what the term “medical trend” refers to). Assuming that medical trend is 8%, the cost of the claim in year two will be $108,000. If your deductible has stayed the same, you will still pay the first $50,000, but the stop-loss carrier will pay $58,000.

In this way, a medical trend of 8% represents an increase of 16% for the carrier. When we look at third-year costs, the difference becomes even starker. A further 8% increase on $108,000 puts the total price at $116,640, or a 33.3% increase to the carrier as compared to year 1.

So, while the employer’s cost for the claim remained flat, the carrier’s cost has increased more by than 33% over two years. Carriers will naturally pass these increased costs along to the employer through increased premiums.

This example was for a self-insured employer using stop-loss, but the same phenomenon will impact fully-insured or level-funded employers in the form of increased pooling charges. The principle is the same: rising claims impact the carrier at a higher rate than they do the insured, and the carrier will seek to offset those costs.

Accelerating factors

Leveraged trend is a mathematical phenomenon that always exists, but several other things amplify overall costs, particularly the cost of large claims.

The two major factors that will further accelerate the underlying medical trend are inflation and high-cost claims.

The first is inflation. Our current economic situation is unusual in that we have a combination of high inflation, negative growth in the overall economy, and a highly competitive labor market. Approximately half of a hospital’s overall expenses are related to labor, according to the American Hospital Association. As competition increases for talent in nursing, medicine, and hospital administration, the cost of attracting and retaining medical employees is sure to increase. Wage inflation drives medical inflation, which is amplified by leveraged trend.

The second driver of medical trend is the increasing frequency of high-cost, multi-year claims. As we covered in our very first article in The Contrarian, we are likely to see new gene therapies approved for conditions ranging from refractory follicular lymphoma, hemophilia A and B, and diabetic peripheral neuropathy. These are medically exciting treatments for devastating conditions, but they come with staggering financial costs. This will disproportionately increase the cost of large claims.

As we often say, it is no longer a question of whether you are likely to face a million-dollar claim, it is a question of when. Between interventions for cancer, new gene therapies, hemophilia, or end-stage renal disease (“ESRD”), employers can no longer afford to ignore the prevalence of this type of claim.

What to Do

The first priority for an employer us to take air out of the proverbial balloon by trying to reduce medical costs. The smaller the denominator, the smaller the impact of inflation and leveraged trend. You probably cannot do that if you’re fully-insured or level-funded, as you cannot pull the appropriate levers.

After that, an employer should protect themselves from the volatility of these large/increasing claims. If you are fully-insured or level funded, you’ll feel the impact of greater medical inflation and leveraged trend and a further multiplier in the form of administrative expenses and profit loads.

If you are self-insured, a bare-bones stop-loss policy does not adequately protect employers from the impact of high-cost claims. A ParetoHealth captive provides far more insurance and protection against these large and ongoing claims. The first part of this protection is our 30% cap on stop-loss premium increases. 30% seems like a lot but considering that this premium is such a low percentage of your overall costs, it only leads, on average, to a 7.5% increase in spending. That’s your worst-case scenario, and it doesn’t happen often.

The second is our “No New Lasers” guarantee. Many stop-loss policies include a provision like this, however, they only last the next 12 months. Ours stays in effect for the entire lifetime of your Membership. In all the time we’ve been in business, we have issued exactly zero new lasers.

As always, we need to emphasize one fact: fully-insured employers face a significantly worse situation when medical trend increases than do self-insured employers. Stop-loss premium is a much lower percentage of overall spending for the former than fully-insured premium is for the latter. Additionally, self-insured employers can control the types of benefits they offer, eliminating unnecessary and unused benefits and identifying strategies and implementing high-value programs that address the unique needs of their employees. Fully-insured plans also place more of your healthcare spending in the purview of the carrier, meaning that they have more opportunities to extract profit from various levels of transaction. The cherry on top comes from higher taxes for fully-insured programs.

This begs the question: how do you reconcile the inadequacy of bare-bones stop-loss with the manifest unworkability of the fully-insured model?

The solution is to add a layer of protection, that insulates the employer and, to a certain extent, the carrier. The only way to ensure that the model continues to work is to reduce the volatility of pricing, to flatten the spikes in overall costs.

ParetoHealth offers that solution, and if you are interested in learning more about how we get this done, I invite you to read our analysis of how a group benefits captive controls volatility here: https://paretohealth.com/blog/5-ways-paretohealths-captives-manage-volatility/

We are quickly approaching everyone’s least favorite time of the year – open enrollment.

If you’re fully insured, you’re on pins and needles, waiting to know if you’re going to get a good renewal or a bad renewal. You cannot do much to prepare for open enrollment, because until you get your renewal, you don’t know what your rates will be or who your carrier will be (since you might change carriers based on renewal and competing prices).

If you’re self-insured, you’re in a much better spot. You are still waiting on a stop loss renewal quote, but that quote is unlikely to prompt a change in TPAs or networks – so you can finalize plan design and schedule open enrollment with confidence.

Many employers and their brokers think that they need to wait to see their stop loss quote before setting accrual rates and scheduling open enrollment – but this couldn’t be further from the truth, at least if you’re in one of ParetoHealth’s captive programs. Let me explain why.

Assume a hypothetical ParetoHealth Member (“XYZ Manufacturing”) with 200 employees has an expiring stop loss premium of $400,000 at a $50,000 specific deductible, and an aggregate attachment point of $1.6m. With their consultant’s help, they should be able to estimate the renewal with enough certainty to determine accrual rates and hold open enrollment – and they can worry about the stop loss renewal later.

In this blog post, I will be going over the process you can use to make this estimation, as well as examining the various factors that go toward making it up. First, I’ll go over aggregate claims, then move onto specific premium, then look at expenses. Add these together, and we can get a good estimate of our total.

If you’ve already gotten your quote, or if you already know how to calculate it, then check out these tips on making open enrollment a success.

Aggregate Claims

To calculate accrual rates, start with the biggest component, the aggregate claims. The industry would have you believe that calculating aggregate claims is as complicated as going to the moon, but that’s just not true. It is very easy to produce an estimate that is directionally correct. At the core of most calculations, you take the monthly aggregate claims (meaning you cap all claims at the level of the specific deductible) over the last 24 months. Next, convert to a PEPM to eliminate fluctuations in enrollment, average them, and then add a factor for medical inflation from the midpoint of the data. You then apply this figure to your anticipated enrollment. I’d suggest assuming an overall medical trend of about 6-8% (this number might go higher in future years given all the pressure on medical wages).

Let’s use some numbers to make this a bit more concrete. These are purely hypothetical, but I’ll assume that the 24-month average claims on a PEPM basis were $490. If we take the $490 and multiply it by 1.08, we get a $530 PEPM rate for expected aggregate claims. We multiple that by 200 employees and by 12 and get an annual estimate of $1.270m. This is the first part of our renewal estimate.

Remember that the stop loss carrier’s aggregate factors don’t determine your claims – your population and their health conditions determine your claims – so don’t fall into the trap of assuming that 80% of their renewal aggregate factors is some magic number. If you want to listen to us make fun of people who do that, listen to our podcast.

Specific Premium

Our hypothetical expiring premium is $400,000 for a $50,000 specific stop loss. Stop loss premiums increase faster than the underlying medical inflation rate due to leveraged trend (you could cite the other podcast here but that might be too much). The industry average for levered trend for a $50,000 specific stop loss is probably 15-17% – but we’ll use 15% to make for easier math. Our employer can therefore assume a 15% increase and calculate a renewal stop loss premium of $460,000. This is the second part of our renewal estimate.

Expenses

If you’re self-insured, you’re paying a TPA (and maybe your consultant) on a PEPM basis. Let’s assume this is $50 PEPM, or a total $120,000. You can probably assume TPA expenses will increase about 3% a year, giving a renewal cost of $124,000. This is the third and final part of our renewal estimate.

Total

We now add all three parts together – aggregate claims (not aggregate factors), specific premium, and expenses – and get a total $1.854m. This can be used to set accrual rates and you can hold open enrollment without waiting for your stop loss renewal.

When I explain this to people, the first reaction I typically get is, “But what happens if the specific increase is a lot higher than 15%”? The answer is “not much.” If the stop loss increase had been 25% instead of 15%, the premium would have been $40,000 higher. The overall cost only increases by 2.2% – not enough to worry about (and the same thing is obviously true with a lower increase). The one caveat I’d put here is that I’m assuming you’re in one of our captives, meaning that your maximum stop loss increase is 30%. If you aren’t in one of our captives, it’s possible you could have a massive increase in your stop loss premium – either directly or using lasers – but that just highlights why you want to be in our captives.

The bulk of the estimate is in the aggregate claims, so that is where the variance is likely to come from, not the specific premium. If you have anything unexpected going on with your aggregate claims, ask for help – from your broker, an actuary, or someone at Pareto.

But remember that no matter where you set your estimate losses, aggregate factors, and accrual rates, they are all just estimates. They will be tested over the next 12-18 months, and it is very unlikely you’ll be spot on – some years you’ll overshoot and some years you’ll undershoot – but the amounts are small and easily adjusted in your financial statements.

So yes, open enrollment sucks – but if you’re in one of our captives, it doesn’t have to be a last second mad dash. It can be scheduled months in advance, and you can spend your time worrying about what is driving costs and what do to about it – not the small variability in a stop loss renewal.

Once you calculate your self-insured costs to plan for open enrollment – or get your renewal quote – then the time has come to communicate what you’ve found out about your benefits package to employees.

Whether you’re a seasoned pro who has managed open enrollment many times before or a relative newcomer to this particular task, there are certain things you can do to make it a success.

Open enrollment is a perfect chance to engage your employees about their health benefits. It gives them an opportunity to understand their benefits plan better and ensure they use them effectively. It also helps them get a look behind the scenes at the costs, administrative work, and future perspective of these plans, allowing them to plan for the future with more confidence. All of this is an excellent way of retaining high-quality talent.

1. Provide in-person sit-down enrollment sessions or open office hours for them to ask questions. If you deliver the information with a personal touch, they will receive and retain it better. Plus, you will be better positioned to answer questions and allay any concerns that they might have about the specifics of their programs.

2. Make sure employees understand payroll contribution frequency, when contributions start, and anything else that may impact their paycheck. This eliminates unpleasant surprises when plans kick in.

3. Related to the previous point, give employees a tool to calculate exactly how much their benefits package will cost before they make the choice. It can be as simple as an Excel table to show them a variety of different costs: the annual election cost, the cost of copays or deductible, and their personal out-of-pocket maximum. This helps them decide based on the specifics of the situation, not just one factor taken in isolation.

4. If there are any significant changes to your benefits package, present them to the entire company in-person or on video. Personal messaging fosters an environment that shows you care about your employees, rather than making changes without public explanation or warning. Whenever possible, include an interactive portion to this presentation to let your employees ask questions, as well. Transparency is always the best policy.

5. Provide the appropriate time for employees to consider their options before making a final decision. However, it’s important to get the timing of this issue right – give them enough time, but not too much. In my experience, give them two weeks to think about it, but no more. If you wait too long, people might forget, but if you don’t afford them enough time, adoption rates may suffer because people don’t have enough time to ask questions or properly evaluate selections.

6. Invite eligible family members to attend open enrollment meetings along with the employees. Spouses may offer important ideas and contributions that aid in the decision-making process, and they also deserve a comprehensive understanding of the package of services. If they will be using them (and many do), then they have a right to get a fuller picture of what is going on.

7. Be as open as possible about how much the company spends on benefits. Transparency helps employees appreciate the actual costs involved and gives them a fuller picture of their entire compensation package. People feel more valued if they know that their total compensation is greater than just their salary, it includes additional costs as well. Letting people know how much you value their contributions is a great way of retaining them.

8. Require employees to actively opt out of benefits. This helps ensure that they have viewed their options. Encouraging conscious decision-making is always better if you want them to make their decisions thoughtfully and weigh all of their options.

9. Provide paper copies of your enrollment materials. Not everyone likes digital versions and giving people information in a variety of formats makes it easier for everyone. A variety of media considers various learning styles and helps your employees retain the information better.

10. Make sure employees know when they will get ID cards (or how to access them digitally) and when benefits become effective. Clarity on these points prevents costly misunderstandings, and it also helps people plan appropriately. Additionally, people appreciate knowing that you have planned out their benefits program wisely and in advance. Getting early notice of when they are going to get ID cards is just one way of making this happen.

11. Ensure employees always know where they can access summaries of benefits and coverage, as well as what resources are provided along with the benefits (telemedicine, health guides, etc.) so that they can always easily review benefit features. Make sure these are as clear as possible since many people do not think about their benefits until they have a health problem. When they are in a stressful situation such as this, it is more difficult to recall information.

12. Give employees a designated time during the day to review their options rather than requiring them to do it outside of work hours. Nobody likes homework, after all.

With these tips, you’ll be sure to have a successful open enrollment season this year. Clear, effective communication is the lifeblood of any organization, and your business is no different. We have to do everything we can to make sure that people can make the best decisions for themselves if we want a well-functioning, contented group of people working with us.

In our knowledge segment, we talk a little bit about a big expense – pharmaceuticals. Many employers don’t know that prescription drugs make up 25-30% of their total healthcare spend. In fact, these numbers are projected to get more dramatic, reaching 50% in the next few years.

Then we talk with Jake Frenz of SmithRx about the ways that we can continue creating value in the pharmaceutical space, his history of serving in the Marines, and a short digression into… classical music? In between Andrew Clayton’s prospects as a classical pianist, ski trips, and some shots taken at golf, we discussed the specific levers that can fix the problems of outsized pharmaceutical prices.

Finally, in the “you know they’re a knucklehead when…” section, we discussed the role of people skills versus strategic vision in relationship-based businesses. It turns out – who knew? – that if you’re giving advice to someone, you need more than a good golf swing and a box of donuts.

One of the most significant hurdles faced by self-insured employers – especially those new to self-funding – is how to interpret the information and feedback you receive now that they have access to plan data. Even “blinded” data offers a tremendous opportunity to reveal claims trends and identify actionable strategies.

For those of us who have been immersed in the sphere for more years than we care to admit, gleaning insight and shaping strategies can seem obvious. But the things that are intuitive and obvious to us are often the result of our experience, and if you don’t have that same degree of experience, these things can be opaque, confusing, or seem contrary to common sense.

As stewards of self-insured benefits plans, how can we bridge this knowledge gap? How can we lend our expertise to improve the experience of employers using our funding methods? And how can we carry the burden of maintaining these strategies, so employers don’t have to?

One of the ways that we get this done involves our use of data, our flexible cost-containment measures, and good old-fashioned industry expertise to guide the owners of our captives – the Members.

We deliver this guidance through ParetoHealth Playbooks.

To explain what these do and their role in our benefits strategies, we have to go right back to the beginning.

We started ParetoHealth in 2011 and cost containment was central to our mission from day one. The approach was simple. Members implemented health risk assessments, conducted biometric screenings, and encouraged tobacco cessation. These basic strategies helped employers support the health and well-being of their employees.

These remain good foundational measures, but things have evolved dramatically. Today, a variety of strategically significant cost-saving measures are united under a single umbrella, ParetoHealth’s Integrated Cost Management (“ICM”) program. The ICM program is an optional solution for ParetoHealth Members, who are also welcome to opt out if they decide it’s not right for their group.

Launched in January of 2020, ICM analyzes employer-specific data and produces a customized, actionable plan for that group based on their unique data. Too often, “strategies” are based on the data of an entire industry or captive. Landing on an effective strategy is much like swinging away at a pinata while blindfolded – sure, there’s a chance you hit it, but there’s a better chance that you miss the mark completely. ICM is based on more than hope and luck – the strategies succeed because they respond to the specific needs of the group. Through a careful analysis of the data, we identify the most effective cost-management options for that group and eliminate programs that aren’t likely to offer much impact.

When it comes to programs, ICM expands the measures of earlier days to include a variety of fully integrated services, emergency interventions, and retrospective data analysis that helps our Members chart a course into the future. These things work in tandem to deliver a long-term solution to control costs while safeguarding the well-being of the people who work for them.

So, in other words, these playbooks are deep analyses of existing health plan data, which we deliver to everyone on our ICM platform. We eliminate the guesswork and maximize the ROI. After identifying the right strategies, we provide straightforward – often turnkey – advice on how to implement these strategies and optimize them for the future. We continually reanalyze the data and propose adjustments based on the latest data and trends.

Gone are the days when employers could only reduce healthcare spending by cutting their benefits. By implementing a data-driven, actionable plan, ICM allows ParetoHealth Members to embrace a true cost-management strategy that will serve them well into the future.

In this episode, we go over the phenomenon of medical inflation and what parts of the COVID-19 pandemic have contributed to rising medical costs – as well as what self-insured employers can do about it.

Then we chat with Brian Olsen of Sterling Seacrest Pritchard (SSP) to talk about his deep, committed relationship with self-funding and why that means we need a dating site for SIIA members. He shares one great insight about the often-misunderstood relationship between high claims and self-funded plans that you won’t want to miss.

Finally, we discuss one knucklehead move that too many brokers use in a feeble attempt to contain costs. It’s the epitome of short-term thinking. Is your broker guilty of this particular howler?

Employers must have a sound strategy to combat rising costs

You’ve heard the grim statistic – Americans pay more for healthcare than any other nation but receive less treatment and poorer outcomes. Spending on drugs and medication makes up a large portion of these costs. According to The Peter G. Peterson Foundation, U.S. healthcare spending averages $12,500 per person. By comparison, countries such as Canada, Austria, and France only pay about one-third as much1.

The Congressional Budget Office has calculated that the share of US healthcare spending on prescription drugs has risen from 5% of the total in 1980 to almost 10% in 2018. Both the number of prescriptions written and their overall costs have increased.

But why do drugs cost so much? Among the reasons:

1. The cost of drug research and development (R&D) is massive

This factor is the primary driver of the high cost of drugs. The process of turning raw materials – whether natural or synthetic – into drugs safe for consumption is extremely costly. The National Academy of Sciences revealed that it costs anywhere between hundreds of millions of dollars to $2 billion to bring a drug to the market2. Also, consider that nearly 9 out of every 10 drugs developed never make it past clinical trials3. The price of a prescription drug includes all the research and development costs of failed drugs, plus the cost to manufacture your prescription drug, plus a layer of profit for the drug company. Add all of these things together and you face a whopping price tag.

2. A lack of market competition and drug-specific monopolies

In the prescription drug industry, a single company often has a monopoly on the rights to a drug. Thanks to patent exclusivity, they get to produce, distribute, and sell it without any competition.

Also, since drugs are necessities and not luxury goods (despite some drugs being priced as high as luxury goods), drugmakers can set prices that they know people – and insurers – will have no choice but to pay.

3. “Pay for delay” agreements

Generic alternatives help to decrease the costs of drugs. When the patent exclusivity of a drug expires, other companies can develop generic drugs – ones that function the same but aren’t branded.

To stall this, pharmaceutical companies who own the patents to the drug may engage their competitors in “pay for delay” agreements, whereby they pay their competitors to delay producing and launching generic versions.

As a result, a single drug company may continue to hold a significant market share of a drug well after expiration of patent exclusivity.

4. Patent evergreening

Going back to patent exclusivity, drugmakers sometimes engage in “evergreening” to extend their exclusive rights to a drug. There are a few ways they can do this, such as repurposing or altering the drug.

For example, if the medication was formerly distributed in pill form, pharmaceutical companies may revamp the drug by turning it into a powder. They rename the drug and apply for new patents, giving them extended rights to expiring patents.

5. Lobbying from Big Pharma

The power of pharmaceutical companies is massive, with the lobbying group for the pharmaceutical industry spending about $27.5 million on lobbying activities in 2018 alone4. They’ve managed to achieve this through a vicious cycle of leveraging money to secure power to continuously grow financially. It’s a loop that leads to more profits for drugmakers and the intermediaries involved.

As prescription drug costs rise at a rate of 2 to 3 times that of inflation, Congress has responded with bills to curtail costs2. But given the mammoth lobbying machine of big pharma, the likelihood of successful legislative reform is dubious, at best.

6. Drugs don’t have price regulations

The U.S. Food and Drug Administration (FDA) regulates how new drugs are tested, marketed, and released on the market. What they don’t regulate (and control) are prescription drug prices and enforceable mechanisms for value-based pricing5. That role goes to drug companies who very clearly have an interest to price drugs as high as possible.

7. There is no price ceiling on drugs

According to a report by Healthline, the U.S. government does not set ceiling prices like in other countries6. Because of this, the price for an annual supply of certain drugs can cost as much as a single-family home.

8. The cost of marketing and advertising drugs

Did you know that in many pharmaceutical companies, the cost of marketing and advertising can go as high as – if not even higher than – a drug’s R&D costs8? Marketing and advertising drugs is a hot business, especially between drug companies and healthcare professionals, to influence the medical choices of patients.

9. A lack of transparency in the chain, with intermediaries that complicate the whole process

Intermediaries such as insurance companies and Pharmacy Benefit Managers (PBMs) play a key role in getting drugs from the makers to the payers – but they can also contribute to the expense of drugs. It’s a complicated multi-player system where many entities are each taking a margin, and the employers and individuals who pay for healthcare plans suffer the brunt of the cost.

The maddening reality for employer-sponsored health plans (and consumers) is these particular factors are largely beyond their control, and absent widespread reform within the industry, costs will continue to climb. However, there are strategies and resources for employers that very effectively help employers to manage the costs. Contact ParetoHealth to learn more.

References

- 1 Peter G Peterson Foundation (2022) Why Are Americans Paying More For Healthcare?. Retrieved July 8, 2022, from https://www.pgpf.org/blog/2022/02/why-are-americans-paying-more-for-healthcare

- 2 National Academy of Sciences (2022) Why Do Drugs Cost So Much? Retrieved 8 July, 2022, from https://thesciencebehindit.org/why-do-drugs-cost-so-much/

- 3 Congressional Budget Office (2021) Research And Development In The Pharmaceutical Industry. Retrieved 8 July, 2022, from https://www.cbo.gov/publication/57126

- 4 Scutti, S. (2019) Big Pharma spends record millions on lobbying amid pressure to lower drug prices. CNN. Retrieved 7 July, 2022, from https://edition.cnn.com/2019/01/23/health/phrma-lobbying-costs-bn/index.html

- 5 Rajkumar S.V. (2020) The high cost of prescription drugs: causes and solutions. Blood Cancer Journal. Retrieved 8 July, 2022, from https://www.nature.com/articles/s41408-020-0338-x

- 6 Curley, C. (2021) Prescription Drug Prices in the U.S. Are Twice as High: Here’s Why. Healthline. Retrieved 8 July, 2022, from https://www.healthline.com/health-news/prescription-drug-prices-in-the-u-s-are-twice-as-high-heres-why

- 7 NPR, Kodjak A. (2019) Prescription Drug Costs Driven by Manufacturer Price Hikes, Not Innovation. NPR. Retrieved 7 July, 2022, from https://www.npr.org/sections/health-shots/2019/01/07/682986630/prescription-drug-costs-driven-by-manufacturer-price-hikes-not-innovation

- 8 Emanuel, E.J. (2019) Big Pharma’s Go-To Defense of Soaring Drug Prices Doesn’t Add Up. The Atlantic. Retrieved 7 July, 2022, from https://www.theatlantic.com/health/archive/2019/03/drug-prices-high-cost-research-and-development/585253/

How is anyone able to buy specialty pharmaceuticals without going broke? What are some of the economic pressures on doctors to prescribe expensive meds? Where is Andrew Clayton hiding, and will he be back next time?

Join us with special guest host Ashley Hull and guest Rashaun Reid of ParetoHealth as they team up with Andrew Cavenagh to tackle these questions in an updated format.

Along the way, they go into why taking the convenient route when you should be helping people is a classic knucklehead move, the strange phenomenon of giving up transparency for a few dollars off your PEPM costs, and how to educate physicians on best pharmaceutical practices.

How do you provide first-class healthcare benefits while also containing costs?

That’s the main question of this live episode, recorded with Suzanne Lutz, Laura Williams, and Santina Daily, three captive Members from very different industries and backgrounds. What they all have in common is a complete dedication to the well-being of their employees and a desire to change that relationship.

This is only a small part of the value that you can get from a ParetoHealth Members’ Meeting. If the advice here resonates with you, visit https://paretohealth.com to learn more.

Did you ever wonder why cost containment is one of our core differentiators at ParetoHealth? Do you want to know what ideas and beliefs fuel our passion for this important part of our mission?

In this ongoing series, I’m going to break down a few fundamental concepts related to the U.S. healthcare delivery system and the associated impact to how we consume and pay for care. Since it’s such a relevant and intricate topic, it’s going to take more than one article.

By the way, if you’re interested in the historical context – how we came to be a nation that spends more per capita on healthcare than any other industrialized country while ranking poorly in quality, access, and outcomes – I recommend this article from the Kaiser Family Foundation, as well as this CNBC treatment. They aren’t strictly necessary to understand the ideas I am going to put forward here, but they do provide a nice amount of context.

One of the most important aspects of the healthcare market is that it doesn’t function the way other markets do. Notably, it lacks price transparency.

What is price transparency? You may have heard about it on the news or during a Presidential debate in the last few years, but it is just a fancy way of talking about something that we do everywhere else for goods or services we consume — shopping around, or “consumer choice.” I’m going to use a simplified series of examples to demonstrate why such a simple idea is so powerful.

To put this into some perspective: let’s say you want to get an oil change for your car. At one place it costs $185, and at another one just down the street the same oil change costs $30.

Not exactly a difficult choice, right? But it’s a choice that most traditional health plans actively discourage people from making.

Think about it: you go to the pharmacy, provide your last name and date of birth, pay your $10 co-pay, and walk out with a tiny bottle of pills in a giant paper sack. What nobody has told you is that not only does the actual cost of the drug exceed the $10 you’ve paid, but it also costs $185 to fill the script at this pharmacy while down the street the exact same drug costs $30. Without actively seeking out this information (which by the way, is no small feat either), you would never know this variance exists.

Now, I can already hear the cynics reading this asking: why should I care if someone soaks my insurance for an extra $155? Isn’t that why I have insurance? Don’t they already make enough money?

A fair question. Also, one with varying answers based on who is footing the bill for that $155 difference. Let me explain.

Let’s assume you are covered by a plan that is financed through a traditional “fully insured” arrangement. This means that your employer has entered into a contract with an insurance carrier whereby they pay a specific amount in premium each month (some of that premium is passed along to employees) and in exchange, that insurer will pick up the costs for all covered services, even if they exceed the amount of premium received. Now let’s go back to the prescription example. Do you think the insurance carrier won’t find a way to make that $155 back? Do you think they won’t find a way to pass those costs along to you, or to someone else?

Do you think they aren’t already passing on someone else’s costs to you?

As most of you probably know, insurance is risk-sharing. Everyone who takes out a policy from a particular insurer shares risks with every other person who has a policy. With most commercial health plans, policyholders don’t know the names, risk profiles, or buying behaviors of the other policyholders with whom they are sharing risk.

But you share risk anyway. It doesn’t matter how responsible you are individually – whether as a single employer offering a benefit plan to their employees or an individual covered under a group or individual policy – you are swimming in a risk pool with a bunch of unknowns compounded by a perverse incentive system for providers that rewards the wrong behavior.

Let’s go back to our example of the $155 dollar difference. Multiply it over millions of people sharing risk with you – meaning the anonymous sea of other policyholders – and you’ll begin to understand why this lack of transparency in pricing is such a massive problem.

Price transparency leads to market competition which ultimately leads to lower prices. If one provider is selling a product for $185 and the other is selling an identical product for $30, the first provider has a choice between lowering it and going out of business.

But that only works if the consumer knows this difference exists and they are compelled to care.

Now, from the perspective of pure risk management, wouldn’t it be great if you knew something about the pool of other people whose risk you’re sharing? Wouldn’t it be great to know that they’re doing something to stop spending $185 when they had the opportunity to pay only $30?

That’s another one of those easy questions.

I mentioned that there were varying answers to the “why should I care” question posed earlier. Well, let’s consider an employer who has chosen to self-insure their benefits. In this model, the $155 overspend would be at the cost of the employer, not the insurance carrier. It’s human nature to care a lot more when we have more skin in the game, right? Let’s also consider that said employer is an equity owner of their own insurance company, where they are sharing risk with hundreds of other employers who have also elected to take on the risk of their health plan. Like-mindedness just got a bit more important, right?

Employers who choose to self-fund their benefits with ParetoHealth have access to a suite of tools and solutions, including those in the area of price transparency and patient advocacy, to ensure that their health care dollars are being spent wisely and effectively by informed consumers. They are joined by a group of peers who have the same approach to managing costs. And all of this is protected by a risk financing vehicle that makes it all possible.

Stay tuned for upcoming articles in our series on cost containment where we share additional strategies and solutions that members of our community are using to preserve and improve benefits while also controlling costs.

If you haven’t yet, please use the form below to subscribe to new issues of The Contrarian so you never miss an update.

Guest host: Jack Longstreth, SVP, ParetoHealth

In our second live episode from our San Diego Members’ Meetings Andrew Clayton and guest host Jack Longstreth chat with two VP’s of Human Resources: Kim Bauer of Altra Federal Credit Union and Lisa Levanger of Wasatch Property Management Inc. This episode delivers great conversation about how a high-quality self-insured solution can help develop better relationships with employees, drive an employee-centric culture, and improve retention.